As a business grows, its financial records can become cluttered, inconsistent, or even inaccurate, especially if bookkeeping hasn’t been properly maintained. This is where QuickBooks cleanup services step in. These services go beyond simply tidying up your data; they identify, correct, and organize your financial records within QuickBooks, ensuring your books are accurate, complete, and compliant with accounting regulations.

A well-executed cleanup can save you time, minimize errors, and give you greater confidence when making financial decisions, whether you are preparing for tax season, facing an audit, applying for a loan, or simply seeking clearer financial insights. The process typically involves reviewing your chart of accounts, transactions, bank reconciliations, undeposited funds, open invoices, and vendor balances.

In this blog, we will break down what QuickBooks cleanup entails, why it is essential for your business, the steps involved, and how to choose the right tools or professionals for the job. Whether you are a small business owner or an accountant, understanding the value of QuickBooks Online cleanup can transform the way you manage your finances.

What is the Purpose of QuickBooks Cleanup Services?

The primary purpose of QuickBooks cleanup services is to ensure that your financial records are clean, accurate, and organized, creating a reliable foundation for decision-making and compliance. These services identify and correct bookkeeping errors, remove duplicate entries, update outdated data, and structure your financial information for better accessibility.

With an audit-ready and tax-ready accounting system, businesses can reduce compliance risks, save time, and focus on growth-oriented activities rather than repeatedly fixing past mistakes. A well-maintained QuickBooks account not only improves financial clarity but also enhances cash flow management, minimizes fraud risks, and supports long-term business stability. Here are the key purposes of QuickBooks cleanup services:

- Identify and correct bookkeeping errors to maintain accuracy.

- Remove duplicate transactions and update outdated data.

- Organize financial records for better clarity and compliance.

- Make your accounting system audit-ready and tax-ready

- Reduce compliance issues and reporting errors.

- Save time by preventing repetitive error corrections.

- Enable better decision-making with accurate financial insights.

- Improve tracking of receivables and payables for healthy cash flow.

- Avoid cash shortages by streamlining collection processes.

- Reduce fraud or mismanagement risks through transparent recordkeeping.

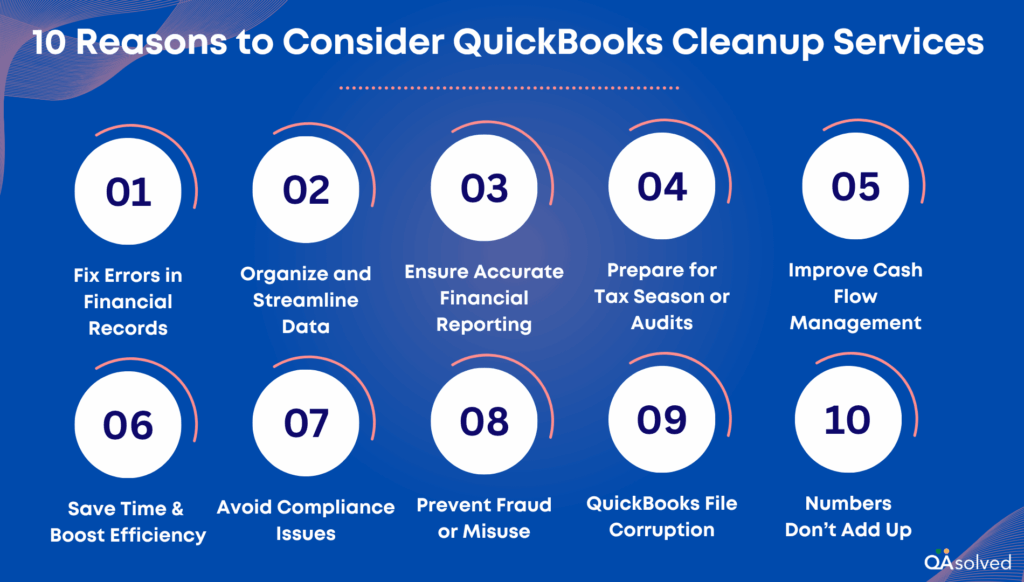

10 Reasons to Consider QuickBooks Cleanup Services

QuickBooks gets more complex and complex as your business grows. Over time, this can result in cluttered records, recurring errors, and sluggish performance. We provide QuickBooks Live cleanup services to help you regain control of your books, correct inconsistencies, and ensure everything is audit-ready and compliant. Cleaning up your accounting software can be incredibly beneficial, whether you’re preparing for tax season or conducting a financial review.

1. Fix Errors in Financial Records

Using cleanup services, you can detect and correct duplicate entries, incorrect data input, and transactions posted to the wrong account. As a result, your books will reflect accurate and meaningful information.

2. Organize and Streamline Data

Keeping records that are disorganized or outdated makes bookkeeping inefficient. By categorizing transactions correctly, merging duplicates, and eliminating unnecessary clutter, you can make your books easier to read and manage.

3. Ensure Accurate Financial Reporting

Clean data is essential for accurate reports. Having a clean profit and loss statement, balance sheet, and cash flow report helps create a true and transparent picture of your finances.

4. Prepare for Tax Season or Audits

Keeping accurate and organized books minimizes stress and error risks during tax filings and audits. Records cleanup ensures compliance and documentation standards are met.

5. Improve Cash Flow Management

Tracking accounts receivable and payable properly helps businesses stay on top of their income and expenses. Financial control is improved by identifying unpaid invoices and overdue bills.

6. Save Time and Boost Efficiency

Cleaning up helps resolve root causes instead of constantly fixing recurring problems. The time you save can be spent on growth, planning, or running your business on a daily basis.

7. Avoid Compliance Issues

Regulatory or legal problems can arise from incorrect categorization or outdated financials. Keeping your records clean ensures compliance with accounting standards and industry regulations.

8. Prevent Fraud or Misuse

A thorough cleanup can reveal suspicious or unauthorized transactions. You can protect your business from fraud and internal misuse by identifying these early.

9. QuickBooks File Corruption

If your files crash or generate errors frequently, they may be corrupted. These files can be repaired or rebuilt by cleanup services to restore functionality and reliability.

10. Numbers Don’t Add Up

It’s often due to hidden transaction issues that your financial reports don’t balance or totals seem off. To restore accuracy and confidence, cleanup uncovers and fixes these issues.

How to Keep Your QuickBooks Cleanup Organized?

It is essential to stay on top of your financial records to ensure smooth business operations-and QuickBooks makes it easier. It’s time to take action if your books are cluttered with outdated entries, miscategorized transactions, or data discrepancies.

Using this QuickBooks clean up checklist, you will be guided through the key steps needed to improve accuracy, tidy up your records, and regain control of your accounting.

1. Review and Reconcile All Accounts

Begin by reconciling your bank, credit card, and loan accounts. Data entry errors, duplicate entries, and missed transactions can be caught by this step.

- Check your QuickBooks records against your bank and credit card statements.

- Ensure accuracy by reconciling balances.

- Any discrepancies or unmatched transactions should be investigated and resolved.

- Review your QuickBooks balance sheet to ensure assets, liabilities, and equity accounts are properly recorded.

2. Clear Out Old and Duplicate Transactions

Duplicate or old transactions can clog your database and cause reports to be skewed.

- Duplicate entries should be removed or merged.

- Mark transactions as paid or cleared once invoices are closed out.

- Delete any outdated data that is no longer needed.

- By removing this clutter, performance can be improved and financial insights can be improved.

3. Verify Customer and Vendor Information

Confusion and billing issues can result from inaccurate or outdated contact records.

- Review all vendor and customer profiles.

- Email addresses, phone numbers, and addresses should be updated.

- To reduce clutter, remove inactive accounts or merge duplicates.

- Keeping records professional and smooth makes communication easier.

4. Audit the Chart of Accounts

The Chart of Accounts is the foundation of your financial system.

- Check for duplicate or unused accounts and consolidate them if necessary.

- Ensure that each account is categorized correctly (e.g., income, expense, liability).

- Inactive accounts should be archived.

- Maintaining compliance and simplifying reporting is possible by keeping the Chart of Accounts streamlined.

5. Assess Accounts Receivable and Payable

Maintaining accurate cash flow management requires regular review of AR and AP.

- Recognize overdue invoices and unpaid bills.

- Pay attention to outstanding payments.

- Uncollectible debts should be written off.

- Adjust balances to reflect actual liabilities and expected income.

- The purpose of this step is to ensure that your current financial situation is realistic.

6. Analyze Key Financial Reports

Making informed business decisions requires regular review of your financial reports.

- Analyze the QuickBooks Profit and Loss Review, Balance Sheet, and Cash Flow Statement.

- Anomalies or outliers should be investigated and corrected.

- Ensure that entries reflect accurate financial standing by adjusting them if necessary.

- It is also helpful to analyze reports consistently in order to identify performance trends and tax planning opportunities.

7. Conduct a QuickBooks Software Usage Review

Analyze how efficiently your team uses QuickBooks features.

- How well are users utilizing automation, reports, and integrations?

- Identify redundant workflows or underused tools.

- Consider QuickBooks Live cleanup or consulting a professional.

- The purpose of this step is to maximize your QuickBooks investment and streamline your internal processes.

8. Backup Your Clean Financial Data

Make sure you back up all your updated financial data after you complete your cleanup process.

- Make use of QuickBooks’ built-in backup tools or store a copy in a secure cloud service.

- Make sure you schedule regular backups going forward to avoid data loss.

- Keeping a backup preserves your hard work and gives you peace of mind.

With this detailed QuickBooks clean up checklist, you’ll not only correct errors and organize data but also lay the groundwork for better financial control, improved performance, and stronger business health.

Now, let’s understand what makes QAsolved an ideal solution for all your QuickBooks cleanup service needs.

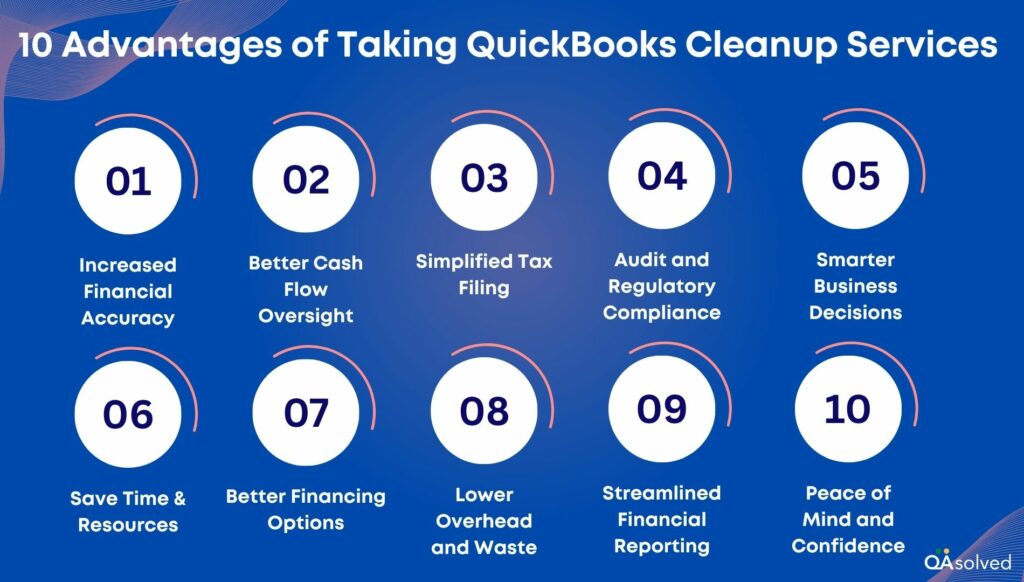

10 Advantages of Taking Our QuickBooks Cleanup Services

Here are some benefits of taking our QuickBooks cleanup services:

1. Increased Financial Accuracy

Using our QuickBooks cleanup services will improve the accuracy of your financial records. You can distort your financial reports over time even by making minor misclassifications or input errors. We ensure your financial data is properly categorized and recorded through a detailed cleanup.

2. Better Cash Flow Oversight

It is easier to monitor your cash flow with greater precision when you keep your books up-to-date. Tracking income and expenses, forecasting cash availability, and planning for upcoming expenses become easier when your financial data is organized. By providing a real-time picture of your company’s liquidity, clean records support more effective budgeting and investment decisions.

3. Simplified Tax Filing

Tax season is significantly less stressful when financial records are well organized. In addition to ensuring that your QuickBooks database is complete, accurate, and compliant with tax laws, we also provide QuickBooks cleanup services.Your business may avoid fines and overpayments if you avoid missed deductions, incorrect filings, or late submissions.

4. Audit and Regulatory Compliance

Compliant and tidy books are a must for companies operating in regulated sectors or undergoing audits. With our cleanup services, you can ensure that your records comply with accounting standards, reducing the possibility of audit flags. With organized documentation, you’ll be prepared for an audit, making the process faster and easier.

5. Smarter Business Decisions

It is easier to make informed decisions when books are accurate. A clean financial record reveals your true financial position, allowing you to make confident decisions regarding staffing, expansion, inventory management, and other strategic initiatives. You can grow your business efficiently and sustainably with clear data.

6. Save Time and Resources

You and your team will spend less time fixing recurring issues or locating old transactions if your records are clean. Using our professional cleanup services, you eliminate unnecessary corrections and administrative overhead, allowing your team to focus on high-impact business activities. Despite concerns about QuickBooks clean up costs, the time and money saved post-cleanup often far outweigh the initial investment.

7. Better Financing Options

Your financial records speak for you when you are seeking loans or investor funding. When credit applications are backed by well-maintained books, lenders are more likely to approve them. Using our services, you can present accurate, professional reports to banks and investors, improving your credibility.

8. Lower Overhead and Waste

Cleanup helps identify duplicate payments, unused subscriptions, and unused services, reducing waste and reducing costs. Lean operations are supported by a clear financial overview, which makes resource allocation easier.

9. Streamlined Financial Reporting

Having reliable records makes monthly, quarterly, and annual reporting easier and more accurate. By ensuring your data is clean and well-organized, reports like profit and loss statements and balance sheets are easier to generate. Insights that are timely and reliable are beneficial to stakeholders and decision-makers.

10. Peace of Mind and Confidence

Lastly, clean books provide peace of mind. It gives you the freedom to focus on your business goals knowing that your data is accurate and managed professionally. Rather than worrying about bookkeeping inconsistencies, our team handles the heavy lifting, so you can operate with confidence and clarity.

Investing in professional QuickBooks cleanup services offers more than just tidy records; it provides the solid foundation for smart financial decisions, improved cash flow, and seamless compliance. By improving accuracy and identifying unnecessary expenses, a cleanup brings clarity and confidence to your business.

In addition, the QuickBooks clean up cost is often a small price to pay for the long-term benefits of well-maintained accounting systems.

Wrapping Up

Keeping your QuickBooks file clean and organized is not just about aesthetics, it’s about building a stronger, more reliable financial foundation for your business. Over time, errors, outdated data, and disorganized records can hinder your ability to make accurate decisions, maintain compliance, and manage cash flow effectively. QuickBooks cleanup services address these challenges head-on, ensuring your books are accurate, up-to-date, and ready for anything from tax season to an audit.

By investing in a professional cleanup, you gain more than just accurate records, you gain time, efficiency, financial clarity, and peace of mind. Whether you’re a small business owner preparing for growth, an accountant supporting multiple clients, or an organization seeking smoother operations, regular QuickBooks maintenance is a smart, long-term investment. With a partner, you can rest assured that your financial data will be restored, optimized, and maintained to the highest standards, allowing you to focus on what matters most, growing your business with confidence.

Frequently Asked Questions

1. Log into QuickBooks Online and Navigate to your dashboard.

2. Go to the Gear icon and select Products and Services under the “Lists” section.

3. Click on “New” to add a new service item.

4. Choose “Service” as the item type.

5. Enter the name and description of the service you’re offering.

6. In the Income Account field, select the correct category (e.g., Service Income or a custom income account you’ve created).

7. If applicable, assign a Sales Tax Category and set your rate or price.

8. Click Save and Close to finish.

Tip: Categorizing services properly helps ensure accurate income tracking, reporting, and tax preparation.

1. Add Contractor as a Vendor

– Go to Expenses > Vendors > New Vendor.

– Enter their info and check Track payments for 1099 (if needed).

2. Categorize the Payment

– When paying them (via bill, check, or expense), choose a category like Contractor Expenses or Subcontractors.

3. Set Up for 1099s (If Applicable)

– Go to Expenses > Vendors > Prepare 1099s to map accounts and verify contractor details.

Pricing for QuickBooks cleanup services varies depending on several factors, such as:

1. The size and complexity of your QuickBooks file

2. How long the file has been in use

3. Whether the file is outdated or regularly maintained

4. If you’re managing multiple company accounts

5. The number of third-party apps connected to your QuickBooks account

Taking into account these elements will help determine the time and effort required for a complete cleanup.

Yes, of course! QuickBooks cleanup can be handled remotely. Experts can access your company files remotely with a stable internet connection and secure remote access. We ensure your data is protected throughout, and we will guide you step-by-step until the cleanup is completed.