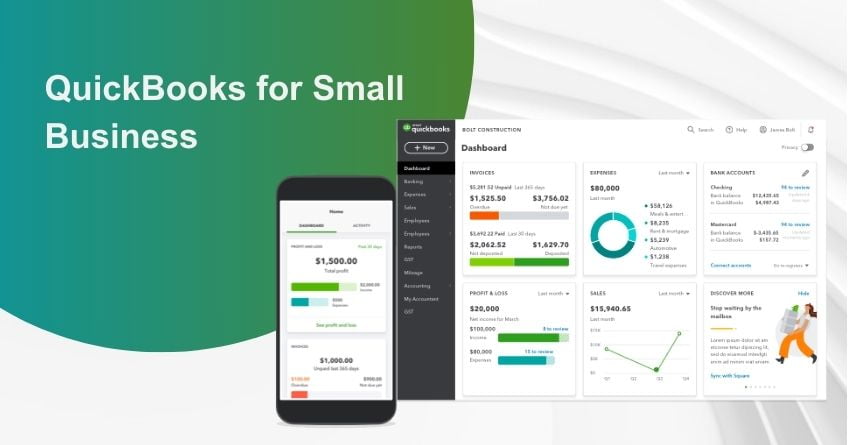

In today’s fast-paced business landscape, small businesses are the backbone of the economy. While their services and products are diverse, one common factor binds them together: the need for efficient financial management. This is where QuickBooks, the financial management software developed by Intuit, comes to the rescue. With its comprehensive features and user-friendly interface, QuickBooks has become a go-to solution for small businesses looking to streamline their finances and make informed decisions.

In this blog, we’ll explore how QuickBooks can be a game-changer for small businesses. We’ll discuss how to set up QuickBooks for small businesses on a desktop, delve into the best accounting software options for small businesses in 2023, and provide a side-by-side comparison to help you choose the perfect fit for your unique needs. Additionally, we’ll address some frequently asked questions to clear any doubts you might have.

Let’s embark on a journey to discover how QuickBooks can revolutionize your small business’s financial management.

How to Set Up QuickBooks for Small Businesses on Desktop?

Setting up QuickBooks for your small business on a desktop is a straightforward process that can be divided into a few key steps:

1. Purchase and Install QuickBooks:

Begin by purchasing the QuickBooks Desktop software that suits your business needs (Pro, Premier, or Enterprise). Once purchased, follow the installation instructions, which are generally simple and user-friendly.

2. Set Up Your Company:

After installation, you’ll be prompted to create a new company file. Enter your company’s information, including its name, address, and industry. You’ll also need to choose the fiscal year and tax form that best aligns with your business.

3. Chart of Accounts:

Customize your Chart of Accounts to match your business structure. This includes adding or modifying income and expense categories, which are specific to your industry.

Must Read: How to Set Up Chart of Accounts in QuickBooks?

4. Connect Your Bank Accounts:

Streamline your financial management by connecting your business bank accounts to QuickBooks. This allows you to import and categorize transactions with ease.

5. Inventory and Products:

If your business deals with inventory, set up your products and services within QuickBooks. This helps you track inventory levels, sales, and purchase orders efficiently.

6. Customers and Vendors:

Enter information for your customers and vendors, facilitating smooth invoicing and expense management. This step simplifies the billing and payment processes.

7. Enter Your Transactions:

Begin entering your financial transactions, including sales, purchases, and expenses. QuickBooks makes it simple to record and categorize these transactions accurately.

8. Reconcile Accounts:

Regularly reconcile your bank and credit card accounts to ensure that your records match the actual account balances. This step is vital for accuracy and fraud prevention.

9. Generate Reports:

Utilize QuickBooks’ robust reporting features to gain insights into your business’s financial health. Track profit and loss, cash flow, and other key performance indicators.

10. Backup Your Data:

Always back up your QuickBooks data to prevent loss in the event of technical issues. Regular backups are crucial for data security.

Best Accounting Software for Small Business in 2023

As 2023 unfolds, small businesses have a wealth of accounting software options. QuickBooks remains a top contender, but it’s essential to explore other options before making a decision.

Here are some of the best accounting software for small businesses in 2023:

1. QuickBooks:

QuickBooks offers desktop and cloud-based versions, making it versatile for various business needs. Its features include expense tracking, invoicing, and tax preparation. The user-friendly interface is a plus for small business owners.

2. Xero:

Xero is a cloud-based accounting software known for its scalability and easy collaboration features. It offers bank reconciliation, customizable invoices, and integrated payroll options.

3. Wave:

Wave is a free accounting software solution ideal for small businesses with basic financial management needs. It offers features such as invoicing, expense tracking, and reporting.

4. FreshBooks:

FreshBooks is a user-friendly cloud accounting solution. It simplifies invoicing, expense tracking, and time tracking. FreshBooks is excellent for service-based businesses.

5. Zoho Books:

Zoho Books is a cloud accounting software that offers comprehensive features, including project tracking, inventory management, and customizable financial reports.

6. Sage 50cloud:

Sage 50cloud is a desktop accounting software with powerful features for managing finances, inventory, and payroll. It’s particularly suitable for businesses with complex accounting needs.

Compare the Best Accounting Software for Small Businesses

Choosing the right accounting software is a critical decision for any small business owner. To help you make an informed choice, let’s compare QuickBooks with some of the other top accounting software options:

1. QuickBooks vs Xero:

– Intuit’s QuickBooks offers both desktop and cloud-based solutions, while Xero is a cloud-based platform.

– QuickBooks is known for its extensive reporting capabilities, while Xero excels in collaboration and integration with third-party apps.

– Xero has a reputation for strong bank reconciliation features, making it an excellent choice for businesses that prioritize bank account management.

2. QuickBooks vs Wave:

– QuickBooks is more feature-rich and offers more advanced financial management tools compared to Wave, which is a more basic, free option.

– Wave is an excellent choice for freelancers and very small businesses with simple financial needs, while QuickBooks caters to a broader range of business types.

3. QuickBooks vs FreshBooks:

– FreshBooks is designed primarily for service-based businesses, while QuickBooks caters to a wider range of industries and business models.

– QuickBooks offers more robust inventory management capabilities, making it suitable for businesses with physical products.

Conclusion – QuickBooks for Small Business

In conclusion, QuickBooks is a powerful tool that can revolutionize your small business’s financial management. However, it’s essential to explore your options and select the accounting software that best suits your specific needs. The best accounting software for small businesses in 2023 offers a range of features and scalability, allowing you to focus on growing your business while maintaining financial efficiency. Make an informed decision, and you’ll be well on your way to achieving financial success. If you need any help, do not hesitate to contact us at +1-888-245-6075.

Frequently Asked Questions (FAQs)

Yes, QuickBooks is a versatile choice for startups. It offers different versions, so you can choose the one that aligns with your business’s needs and budget.

Yes, it’s possible to switch from one accounting software to another. However, it may involve data migration and can be complex, so it’s essential to plan and seek professional guidance if needed.

The choice between QuickBooks Online and QuickBooks Desktop depends on your specific needs. Online is cloud-based and offers real-time access, while Desktop is installed on your computer and may offer more advanced features. Consider your business’s requirements and preferences before making a decision.

Yes, QuickBooks offers integration with a wide range of third-party apps and tools. This allows you to expand its functionality to suit your business’s unique requirements.