In QuickBooks, reconciliation involves comparing two related accounts. If the need arises to reverse this action, you can use the “undo reconciliation” feature. This reversal may be necessary due to inaccuracies in transaction dates or a flawed data sequence. To assist you in navigating the process of undoing reconciliation in QuickBooks and its various versions, refer to this article. In this article, you will find step-by-step instructions on ‘how to undo reconciliation in QuickBooks Online’, QuickBooks Desktop, and other software iterations. Additionally, this article also explores multiple reasons for reversing reconciliations in QuickBooks.

What is the Need to Undo Bank Reconciliation?

Why might you want to undo a Bank Reconciliation in QuickBooks? Well, there are situations where it’s necessary, especially when your QuickBooks balance sheet doesn’t align with the bank statement. Let’s dive into a few scenarios where undoing a bank reconciliation is essential:

- If a payment was documented with an incorrect date, undo reconciliation will rectify the discrepancy and ensure accurate date entries.

- In case a transaction was initially marked as cleared but later found to be uncleared, undo reconciliation will address the issue and accurately reflect the status of the transaction.

- A bank reconciliation was forced and now requires correction through the proper method. Undo reconciliation will rectify the forced reconciliation and maintain accurate financial records.

- If the bank statement date was either incorrect or did not correspond to an actual day, the utilization will align the bank statement date accurately and maintain synchronization.

What are the Advantages of Account Reconciliation?

Account reconciliation isn’t just a routine financial check; it’s a powerful tool with a range of benefits. Here are some major advantages:

- Spots Errors with Precision: Account reconciliation serves as a meticulous detective, helping you unearth any discrepancies in your account and bookkeeping activities. This meticulous examination ensures that your financial records align with actual transactions, minimizing the risk of errors slipping through unnoticed.

- Strategic Preparation for Future Transactions: Imagine issuing a payment to a vendor, only to face delays in their processing. Without proper reconciliation, it’s easy to overlook these delays and inadvertently miss deducting the amount from your accounts. Account reconciliation acts as your financial GPS, providing a clear path to tracking all transactions. This proactive approach not only prevents oversights but also sets the stage for informed decision-making in future financial activities.

- Maintaining Accuracy in Business Deposits: Beyond transactional accuracy, account reconciliation plays a pivotal role in ensuring the correctness of business deposits. By regularly reconciling accounts, you create a reliable system that safeguards against discrepancies in your business deposits. This accuracy, in turn, fosters financial stability and enhances your overall financial management.

In essence, account reconciliation isn’t just about balancing the books; it’s about empowering your financial strategy, fostering accuracy, and positioning your business for sustained success. Stay tuned as we explore more insights and tips on optimizing your financial processes!

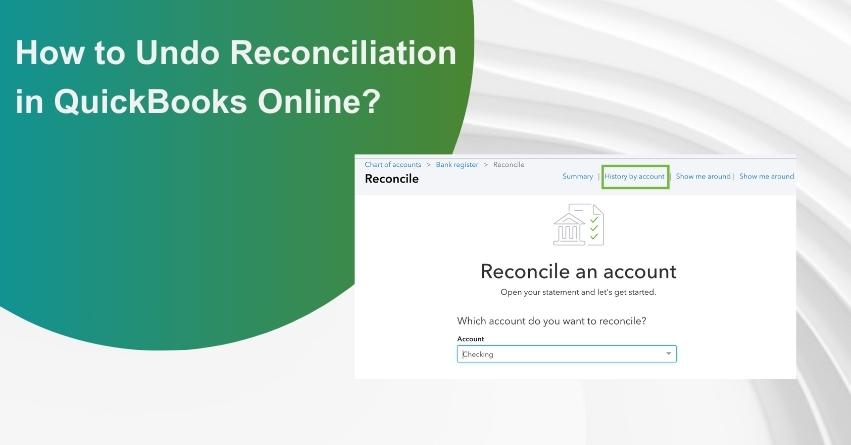

How to Undo or Delete a Reconciliation of QuickBooks Online Account?

QuickBooks Online users can conveniently undo transaction reconciliations directly from their accounts. Following this, it is essential to navigate to the Registers section on the Banking page, where the “R” indicator is visible next to the recorded data slated for undo reconciliation. Deleting this marker from the table effectively alters the reconciliation status. This adjustment becomes possible once the user selects the Transaction option.

Explore the steps below to gain insights into how to Unreconcile in QuickBooks Online:

- Begin by launching “QuickBooks Online.”

- Choose “Registers” from the “Banking” drop-down menu.

- From the drop-down menu within the “Register” tab, select the relevant “Account.”

- Click on the transaction you wish to unreconcile.

- Finally, remove the “R” designation to revert its status to unreconciled.

Note: If your objective is to reconcile transactions for a specific period, consider printing a list of the reconciled transactions using the “Reconcile” option available in the “Banking” menu.

Undo a Reconciliation in QuickBooks Online Accountant Version (QBOA)

Steps to Reverse Bank Reconciliation in QuickBooks Online Accountant Version (QBOA):

- Start by clicking on the “Gear” icon.

- Next, select “Reconcile” under tools.

- Choose the specific bank account for the reconciliation you want to undo.

- Hover your mouse over the month of the reconciliation you wish to reverse.

- Look for the UNDO button located to the right of the auto Change column.

- Click on the UNDO button.

- A message will appear on your screen: “Undo Bank Reconciliation In QuickBooks.”

- Click the OK button to confirm.

- You will then see a success display with the message “Undo Bank Reconciliation.”

- Finally, click on the OK button to complete the process.

How to Unreconcile in QuickBooks Desktop?

In the desktop version of QuickBooks, the users can undo the reconciliation to value-protect their transaction data. The QB Desktop users have to access their account as the Administrator and select the company file that requires editing. The undo reconciliation action will be possible through the present Banking menu.

Should you need more assistance, read below and find out more about how to undo reconciliations in QuickBooks Desktop:

- Run “QuickBooks Desktop”.

- Secondly, log in as an “Administrator” by providing the relevant details.

- Now, choose the company file from the drop-down menu.

- Next, go to the “Banking” menu.

- Click on the “Reconcile” menu now.

- Finally, click on “Undo Last Reconciliation” to undo the reconciliation in the QuickBooks Desktop.

Conclusion

When reconciling transactions in QuickBooks or its various versions, there’s no need to fret about potential errors. If mistakes occur and impact bank transactions, fear not, as reconciliation can be easily undone. By perusing this blog, you’ll gain insights into ‘How to Reverse a Reconciliation in QuickBooks Online.’ If you need further assistance, feel free to reach out at the toll-free number: +1-888-245-6075.

Frequently Asked Questions

Yes, you can undo reconciliations in QuickBooks Online. QuickBooks Online provides a feature that allows users, particularly administrators, to reverse a reconciliation in case errors or discrepancies are identified in the reconciled transactions.

Absolutely. If there are errors in a reconciliation in QuickBooks Online, you can fix them by following the appropriate steps. Corrections may involve adjusting transaction details, and ensuring that they match your bank statements accurately.

Yes, you can undo reconciliation for specific transactions by accessing the Reconcile feature in QuickBooks Online.

Undoing reconciliation doesn’t directly affect your transactions, but it’s crucial to review and correct any errors to maintain accurate financial records.

Yes, you can undo reconciliations from previous periods in QuickBooks Online, but it’s recommended to exercise caution and ensure the accuracy of adjustments.