Businesses across the spectrum encounter an inherent financial challenge in the form of facing bad debt. Bad debt materializes when an expected receivable, typically from a customer or client, becomes uncollectible. This predicament often arises when the debtor, due to financial insolvency or other reasons, cannot fulfill their payment obligations.

Effectively managing bad debts emerges as a pivotal aspect of sound financial administration for businesses. Enter QuickBooks, a widely embraced accounting software that serves as a comprehensive tool for tracking and handling financial transactions, including the intricacies of bad debts. QuickBooks equips businesses with features not only to record and monitor receivables but also to efficiently write off bad debts deemed uncollectible. This ensures the maintenance of accurate financial records, providing an authentic reflection of the company’s true financial standing.

In this article, we will analyze how businesses can utilize QuickBooks to manage and write off bad debts, enabling them to uphold robust financial practices and maintain precise accounting records.

What is Bad Debt in Accounting?

In the realm of accounting, a business incurs a loss known as bad debt when it becomes evident that a customer’s receivables are unlikely to be collected. These receivables, which may include outstanding invoices or overdue loan payments, align with the accrual accounting method, recording revenues at the time of sale, regardless of cash receipt. Consequently, when it becomes apparent that these recorded revenues will remain uncollected, the business must appropriately account for them as bad debts.

Significance of Bad Debt in Financial Reporting

The existence of bad debt exerts a direct and noteworthy influence on a company’s financial statements which are mentioned below:

1. Income Statement:

Bad debts are documented as an expense, leading to a reduction in the net income of the business. This adjustment is necessary as the expected revenue from the sales or services provided will not materialize.

2. Balance Sheet:

Bad debts contribute to a decline in the Accounts Receivable balance on the Balance Sheet. This reduction signifies amounts that are no longer anticipated to be collected, impacting the overall asset value of the company.

3. Cash Flow Statement:

Although bad debts do not directly alter cash flow (as the cash was never received), they do affect the Cash Flow Statement by reflecting the company’s efficiency in managing and collecting receivables, thereby influencing the overall financial health.

Steps to Write Off Bad Debt in QuickBooks Online

Here’s a concise step-by-step process to assist you in the efficient management of uncollectible receivables and the process of writing off bad debt in QuickBooks Online (QBO).

A. Reviewing Aging Receivables

- Head to the ‘Reports’ section in QuickBooks.

- Open the ‘Accounts Receivable Aging Detail Report‘ to analyze outstanding receivables.

- Identify non-collectible receivables from the report.

B. Establishing a Bad Debts Expense Account

- Go to ‘Settings’ and select ‘Chart of Accounts.’

- Create a new account, choosing ‘Expenses’ as the account type and ‘Bad Debts’ as the detail type.

- Save the new account.

C. Setting Up a Bad Debt Item

- Within ‘Settings,’ go to ‘Products & Services.’

- Click New and Create a non-inventory item named ‘Bad Debts.’

- Link this item to the ‘Bad Debts‘ account.

- Save and close.

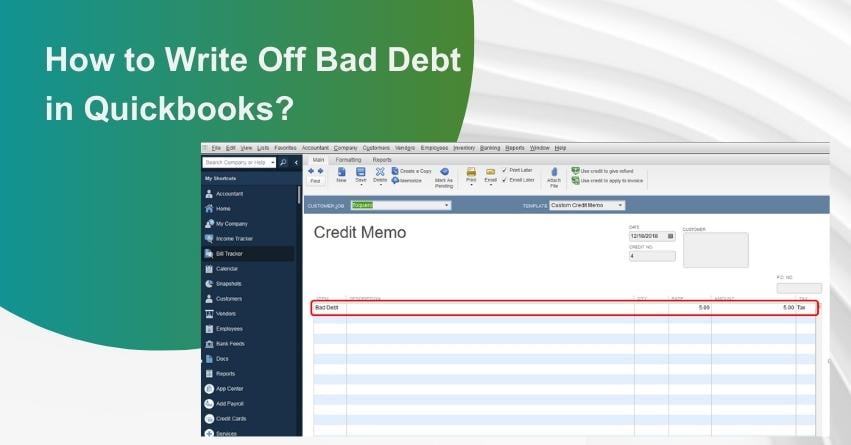

D. Create a Credit Memo for the Bad Debt

- Click ‘+ New‘ and choose ‘Credit Memo.’

- Select the customer linked to the bad debt.

- Choose ‘Bad Debts‘ in the ‘Product/Service‘ area and input the amount.

- Include a note like ‘Bad Debt‘ in the statement message box.

- Save and close.

E. Applying the Credit Memo to the invoice

- Click ‘+ New‘ and go to ‘Receive Payment‘ under ‘Customers.’

- Choose the relevant customer.

- Mark the invoice to be written off in the ‘Outstanding Transactions‘ area.

- Attach the credit memo in the ‘Credits’ section.

- Save and close.

F. Generating a Bad Debt Report

- Return to ‘Settings’ and select ‘Chart of Accounts.’

- Click ‘Run report‘ in the bad debts account row to view all receivables tagged as bad debt.

Additional Recommendations

- In the ‘Customers’ section under ‘Sales,’ mark entities with bad debts.

- Edit customer names to include a marker like ‘Bad Debt‘ or ‘No Credit.’

- For accuracy, consider engaging a QuickBooks certified bookkeeper to categorize transactions and reconcile bank statements regularly.

Steps to Write Off Bad Debts in QuickBooks Desktop

Effectively writing off bad debts in QuickBooks Desktop (QBD) ensures the accuracy of your accounts receivable and net income figures. Here’s a comprehensive explanation of the process:

A. Establishing an Expense Account for Monitoring Bad Debt:

- Navigate to the ‘Lists’ menu and select ‘Chart of Accounts‘ in QuickBooks Desktop.

- In the Chart of Accounts, go to the ‘Account’ menu and choose ‘New.’

- Select ‘Expense’ as the account type and click ‘Continue.’

- Name the new expense account, such as ‘Bad Debt.’

- Save the account to track bad debt losses.

B. Settling Uncollectible Invoices:

- Go to the ‘Customers’ menu and select ‘Receive Payments‘ to manage closing out the unpaid invoice.

- In the ‘Received from‘ field, enter the name of the customer with the uncollectible invoice.

- Set the ‘Payment amount’ to $0.00, indicating no actual payment is received.

- Choose ‘Discounts and credits’ to write off the unpaid amount.

- Input the uncollectible amount in the ‘Amount of Discount’ field.

- Select the bad debt expense account created earlier as the ‘Discount Account.’

- Click ‘Done,’ then ‘Save and Close‘ to officially write off the unpaid invoice amount as bad debt.

Additional Tip:

Monitor customer balances using the ‘Accounts Receivable Aging Detail report‘ to stay informed about open balances, helping identify invoices at risk of becoming bad debts.

Conclusion

Writing off bad debt in QuickBooks Online and QuickBooks Desktop is crucial for financial record accuracy, reflecting a business’s true financial position. Although the process varies slightly between the versions, it serves the same critical purpose. Regularly reviewing accounts receivable and understanding signs of bad debt helps with early intervention. QuickBooks provides an effective system to manage these financial realities, ensuring businesses can focus on growth with confidence in their accurate financial status.

Hope this article helped you resolve the issue, in case you still have any queries related to Writing Off Bad Debt in QuickBooks, feel free to contact us at our Toll-Free number: +1-888-245-6075.

Frequently Asked Questions

In QuickBooks, bad debt refers to money owed to your business that is considered uncollectible, often involving outstanding invoices deemed unlikely to be paid by the customer.

To write off bad debt in QuickBooks Online (QBO), follow the steps given below:

1. Examine outstanding receivables.

2. Establish an expense account for bad debts.

3. Add a bad debt product/service.

4. Issue a credit memo for the written-off debt.

5. Link the credit memo to the relevant invoice.

6. Consider generating a report on bad debts.

The steps to write off bad debt in QuickBooks Desktop involves:

1. Adding an expense account for bad debt tracking.

2. Closing out unpaid invoices by applying a discount representing bad debt.

3. Linking this discount to the bad debt expense account.

Writing off bad debt in QuickBooks is crucial for accurate financial records, reflecting business financial status, aiding in cash flow management, and ensuring compliance with accounting standards.

Yes, if a customer pays after a debt write-off, you can record the payment by reversing the write-off and recording income as usual.

While QuickBooks simplifies the process, consulting an accounting professional is advisable, especially for significant amounts, to address accounting and tax implications properly.

Writing off bad debt can have tax implications, potentially reducing taxable income. Consult with a tax professional for specific advice due to varying tax laws.

A monthly review of Accounts Receivable in QuickBooks is recommended to identify potential bad debts early, allowing timely action.

While complete prevention is challenging, reducing risks can be achieved through credit checks, clear payment terms, and timely payment reminders.

Yes, QuickBooks provides tools and reports, such as the Accounts Receivable Aging Detail report, to effectively identify and manage bad debts.