Staying compliant with IRS regulations is one of the most important responsibilities for any business. Tax season often brings increased scrutiny, and even small mistakes such as missing forms, incorrect classifications, or overlooked deadlines can lead to penalties, audits, or financial setbacks. For business owners, CPAs, and accounting professionals, compliance is not just about filing returns on time; it is about maintaining accurate records and following IRS guidelines year-round. The good news is that with proper planning and awareness, businesses can avoid last-minute chaos and keep their operations firmly on the right side of the law.

In this blog, we’ll dive into why IRS compliance is so critical in today’s evolving business landscape and highlight the most common bookkeeping mistakes that can trigger unwanted IRS notices. We’ll also cover the key tax forms every business owner should know, along with practical ways to stay compliant year-round. Finally, we’ll also name the five best accounting software for tax and IRS compliance. So, let’s begin with it.

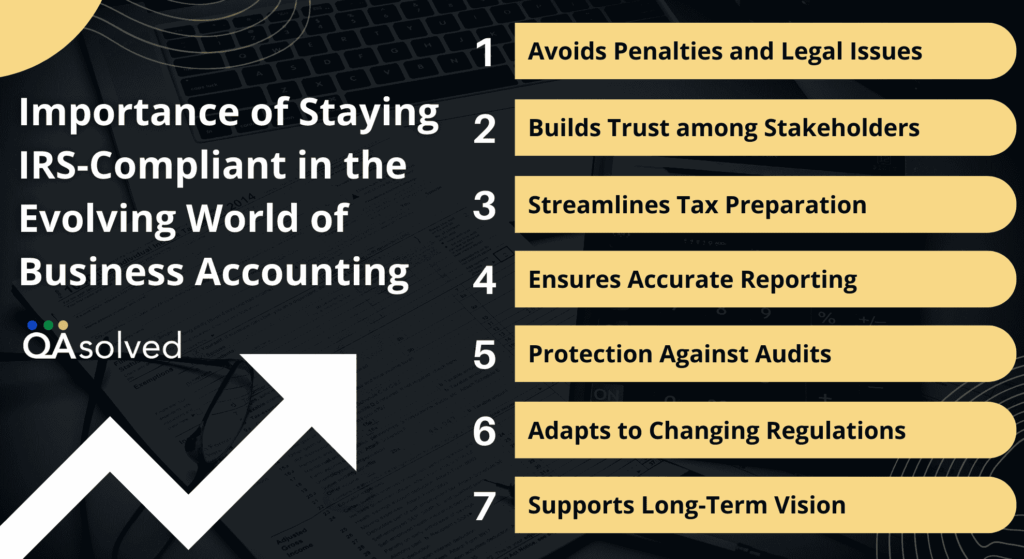

Importance of Staying IRS-Compliant in the Evolving World of Business Accounting

In today’s dynamic business environment, IRS compliance is more than just a legal obligation; it’s a safeguard for financial stability and long-term growth. Considering the impact of legal scrutiny, it has become almost impossible for businesses to manage their books accurately. Here are some key reasons why IRS compliance should always remain a top priority:

1. Avoids Penalties and Legal Issues

When you manage your books with the ultimate precision, you minimize the scope of your business getting hit by fines, interest, and other legal disruptions. This ensures that your resources are not drained and remain available for operational priorities.

2. Builds Trust among Stakeholders

Accurate and compliant records enhance credibility with clients, investors, financial institutions, and regulatory bodies, fostering stronger professional relationships and long-term opportunities for sustainable business growth.

3. Streamlines Tax Preparation

With IRS-compliant software, filing taxes feels less like a headache and more like a smooth routine. It improves accuracy, reduces stress, and allows you to focus on growth instead of being overwhelmed by endless paperwork.

4. Ensures Accurate Reporting

Staying compliant means your reports actually reflect the real health of your business. That clarity helps you make smarter calls, forecast with confidence, and plan for the future without second-guessing your numbers.

5. Protection Against Audits

No one likes the thought of an IRS audit, but compliance makes it far less scary. Organized records and automated reports give you confidence, reduce errors, and keep the entire process transparent and hassle-free.

6. Adapts to Changing Regulations

Tax laws change more often than we’d like, but compliance ensures you’re never left scrambling. By staying ahead, your business remains agile, prepared, and always in step with the latest IRS requirements.

7. Supports Long-Term Vision

A solid, compliant financial system doesn’t just protect you today; it sets you up for tomorrow. It builds trust, attracts investors, and allows your business to expand with confidence, minus unnecessary setbacks.

This is why staying compliant with the IRS regulations has become one of the most crucial aspects for businesses, CPAs, and other accounting professionals.

7 Bookkeeping Errors That May Lead You to IRS Notices and How to Avoid Them

MSMEs are driving a significant shift in the entire corporate scene in the United States. According to a research report by Daniel Wilmoth, dated April 2022, MSMEs in the United States have accounted for 2 out of every 3 jobs in the past 25 years. In this context, we can understand how vital it is for small and medium-sized businesses to maintain financial discipline and stay compliant with IRS regulations. Because even minor bookkeeping errors can snowball into IRS notices, audits, and penalties that drain resources and disrupt growth.

So, here are seven bookkeeping slip-ups that can cause trouble and the steps you can take to prevent them:

1. Mixing Personal and Business Expenses

One of the most common red flags is combining personal and business transactions. Using your business account to pay for vacations, streaming services, or personal meals without properly separating them can invite IRS attention.

How to Avoid It?

Maintain a separate business bank account and business credit card. Keep personal purchases apart, and if mistakes happen, categorize them properly in your records. Not confident? An accountant can help clean things up and keep your books compliant.

2. Failing to Report All Income

Income doesn’t just come through your business bank account. Payments made via PayPal, Venmo, cash, or checks must all be reported. If your bookkeeping doesn’t match third-party reporting, the IRS may see it as underreporting.

How to Avoid It?

Track every dollar, regardless of how you’re paid. Platforms like PayPal and Venmo now report transactions over $600 directly to the IRS. Using IRS-compliant bookkeeping software or working with a professional accountant ensures your records always line up.

3. Not Keeping Receipts or Backup Records

If you’re audited, the IRS won’t take your word for it—they’ll want proof of expenses. Without receipts, statements, or other documentation, even legitimate deductions may be disallowed.

How to Avoid It?

Digitize your receipts by scanning or snapping photos and storing them in a cloud system like QuickBooks, Xero, or Google Drive. Label them clearly for quick access. If managing this feels overwhelming, an accountant can build a reliable filing system for you.

4. Misclassifying Workers (Employee vs. Contractor)

The IRS is strict about worker classification. Labeling someone as a contractor while treating them like an employee could leave you responsible for back taxes, penalties, and interest.

How to Avoid It?

Understand the difference: contractors use their own tools and work independently, while employees work under direct supervision. If you’re uncertain, consult a CPA or employment attorney. It’s far better to clarify upfront than deal with an IRS audit later.

5. Incorrectly Categorizing Expenses

Placing expenses in the wrong categories, like claiming personal costs as business deductions, can skew your books and draw IRS scrutiny.

How to Avoid It?

Familiarize yourself with basic expense categories such as rent, travel, meals, office supplies, and marketing. Apply consistent labels and review entries regularly. With IRS-compliant accounting software, you can automate much of this process and avoid costly mistakes.

6. Skipping Bank Reconciliations

Reconciliation means matching your bookkeeping records to your actual bank or credit card statements. Ignoring this step can result in overlooked errors, duplicate entries, or missing income, all of which may affect tax filings.

How to Avoid It?

Reconcile your accounts at least monthly. Most bookkeeping software makes this simple, but if you’ve fallen behind or aren’t confident in the process, a professional accountant can bring your records up to date and keep them accurate.

7. Filing Late or Not Filing at All

Late filings, or worse, failing to file, can lead to interest charges, penalties, and IRS notices. Even if your business didn’t make a profit, the IRS still expects timely paperwork.

How to Avoid It?

Mark your tax deadlines: March 15 for partnerships and S-Corps, April 15 for sole proprietors. File an extension if needed and pay estimated taxes on time. To stay compliant with IRS requirements, consider having an accountant handle filing and keep you on schedule.

Keeping clean books isn’t just about balancing numbers; it’s about protecting your business from IRS scrutiny. Even small bookkeeping mistakes can quickly escalate into notices, penalties, or audits. To stay compliant with IRS regulations, it’s important to recognize the most common errors and know how to avoid them.

Forms to Fill and Submit to Ensure IRS Compliance

There are several forms that are certainly crucial for businesses of all sizes and verticals to meet legal and tax regulations. For businesses who pay their employees are required to report the payments to the IRS on an information return. Being an entrepreneur or a finance professional, here are the common forms that you can get electronically or by mail in January or February.

Here’s a list of income forms that are crucial to file and submit during the year:

| S. No. | Form Name | Form Description |

| 1 | Forms W-2 | Issued by employers to employees, it reports annual wages and the taxes withheld from paychecks. |

| 2 | Form W-2G | Reports gambling winnings and any federal income tax withheld from those winnings. |

| 3 | Form 1099-K | Sent by payment processors (like PayPal or credit card companies) to report payments made to your business through third-party networks. |

| 4 | Form 1099-G | Reports on certain types of government payments, such as unemployment compensation or state tax refunds. |

| 5 | Form 1099-INT | Used to report interest income earned from banks, financial institutions, or other sources. |

| 6 | Form 1099-DIV | Reports dividends and distributions paid by corporations or mutual funds to shareholders. |

| 7 | Form 1099-NEC | Reports non-employee compensation, typically payments of $600 or more made to freelancers or contractors. |

| 8 | Form 1099-R | Reports distributions from pensions, retirement plans, IRAs, or annuities. |

| 9 | Form 1099-MISC | Used for reporting miscellaneous income such as rent, prizes, or awards not covered by other 1099 forms. |

| 10 | Form SSA-1099 | Issued by the Social Security Administration, it reports the total benefits a person received in a year. |

| 11 | Form 1095-A | Sent by the Health Insurance Marketplace, it provides details about health coverage and is used to claim the Premium Tax Credit. |

So, these are the eleven forms that one should be aware of in order to minimize the threat of hefty penalties from IRS. Now let’s take a look at the best accounting software for IRS and tax compliance.

Also Read: W-2 vs W-4: Key Differences, Benefits, and Why These Tax Forms Matter

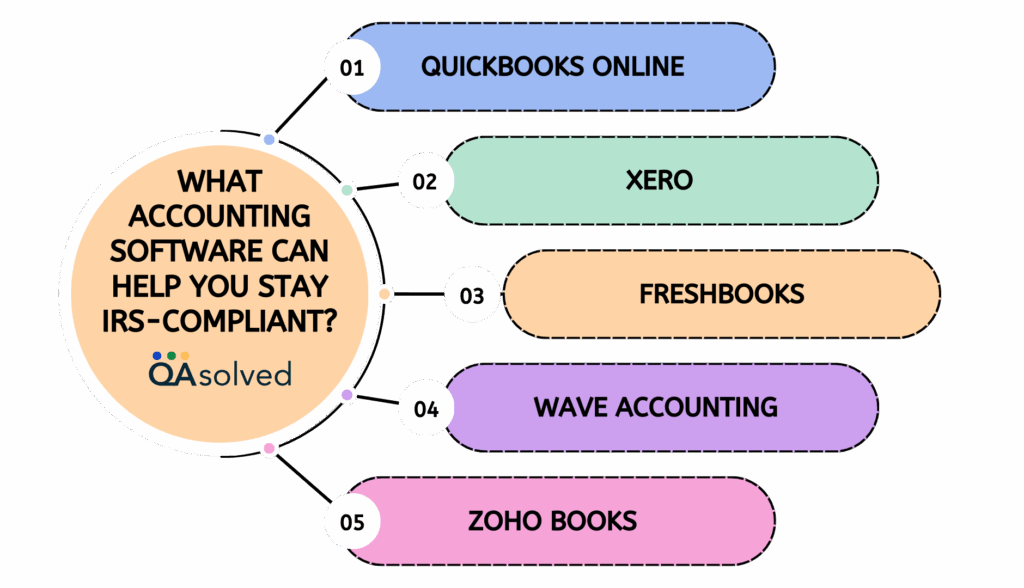

Which Accounting Software Can Help You Stay IRS-Compliant?

Choosing the right accounting software is no longer just about convenience; it’s about ensuring your business stays on the good side of the IRS. From tracking expenses to generating tax-ready reports, the right tool can save you time, reduce errors, and keep you compliant year-round. Here are some of the top accounting software options that can help:

1. QuickBooks Online

QuickBooks is one of the most trusted names in accounting software. It allows businesses to automate tax calculations, generate IRS-ready forms, and stay on top of deadlines. With integrated payroll, expense tracking, and 1099 support, it simplifies compliance for small businesses and CPAs alike.

2. Xero

Xero provides cloud-based accounting that’s perfect for growing businesses. With features like automated bank feeds, expense categorization, and detailed audit trails, it ensures financial records are transparent and IRS-ready. Its collaboration-friendly design also makes it easier for accountants and business owners to stay aligned.

3. FreshBooks

Known for its user-friendly interface, FreshBooks is an excellent choice for freelancers and service-based businesses. It offers easy invoicing, expense management, and time tracking, while also generating reports that meet IRS requirements. Its simplicity makes tax preparation much less stressful.

4. Wave

Wave is a free option that still packs in plenty of compliance features. With income and expense tracking, receipt scanning, and basic reporting, it helps smaller businesses maintain IRS-compliant records without added costs. Paid add-ons like payroll can enhance compliance even further.

5. Zoho Books

Zoho Books combines affordability with powerful compliance features. From GST and tax-ready reports to secure record-keeping, it ensures smooth tax filing. The software also offers integration with payment gateways and bank accounts, which adds extra accuracy for financial records.

Hence, staying IRS-compliant helps you to protect your business from penalties and builds lasting credibility. By avoiding common bookkeeping mistakes, understanding key IRS forms, and using reliable accounting software, you can simplify compliance and focus on growth with confidence.

Conclusion

In a nutshell, IRS compliance is less about fear and more about discipline and preparation. Think of compliance as an investment in both financial clarity and long-term growth. Because gone are the days when IRS compliance meant endless paperwork and sleepless nights. By steering clear of common bookkeeping mistakes, understanding your reporting obligations, and using tools designed to keep you on track, you set your business up for smoother operations year-round.

On top of this, today’s highly capable accounting software makes it easier than ever to stay on top of forms, deadlines, and accurate reporting. When you let technology handle the details, you free up time and energy to focus on what really matters; growing your business.

Frequently Asked Questions

The IRS usually initiates audits when tax returns show discrepancies or unusual patterns. Common triggers include underreporting income, excessive deductions compared to reported earnings, large cash transactions, misclassifying workers, or failing to file required forms. Mathematical errors, mismatched information reported by third parties (like banks or payment platforms), and consistently filing late can also raise red flags.

No, you don’t necessarily have to use IRS-approved software for tax preparation. While the IRS does maintain a list of authorized e-file providers and software for professional tax preparers, many reputable accounting and tax software solutions outside this list can still help you stay IRS-compliant. What really matters is whether the software can generate accurate records, file the correct forms, and keep your data secure.

As long as your chosen software supports compliance requirements and integrates well with your business, it can be just as effective as IRS-approved options.

The IRS 6-year rule applies when a taxpayer fails to report a significant portion of their income. Specifically, if you omit more than 25% of the gross income shown on your return, or if you fail to report over $5,000 related to foreign financial assets, the IRS has up to six years from the date you filed your return to assess additional taxes.

Yes, the IRS generally forgives outstanding tax debt once the 10-year statute of limitations has expired. After this time, the debt is considered uncollectible. However, certain situations such as bankruptcy proceedings, legal disputes, or specific collection actions can extend or pause this 10-year period.

Yes, in some cases the IRS may reduce or remove penalties. This often happens if you can show reasonable cause, such as a natural disaster, serious illness, or other circumstances beyond your control that prevented timely filing or payment. The IRS also offers a first-time penalty abatement program for taxpayers with a clean compliance history. Using IRS-compliant bookkeeping software and staying organized helps you avoid these situations altogether.