Managing accounts receivables effectively is one of the most crucial aspects for maintaining healthy cash flow for a business. An account receivable is money owed to a business by a customer for goods or services that have not yet been paid. Customers purchase products or services on credit and agree to pay later. These sales are typically invoiced so that payments can be collected later. Accounting classifies accounts receivable as an asset. However, if the amount of unpaid receivables accumulates too high, companies are likely to face troubles covering its expenses and bills. Managing accounts receivable effectively is critical to maintaining healthy financial operations.

With QuickBooks, you can manage your accounts receivable and other financial tasks in one place. You can easily manage your receivables and cash flow with QuickBooks, including accessing the A/R Aging Report, creating and sending invoices, and setting up reminders for overdue payments. Whether you are using QuickBooks Online or QuickBooks Desktop, the account receivable feature enhances your cash flow management by simplifying receivables and taking full charge of your business finances.

Moving further in this blog, we’ll thoroughly dive into the intricacies of the accounts receivable in QuickBooks for a better understanding.

What is Account Receivable in QuickBooks?

The term ‘Accounts Receivable’ refers to the outstanding bills that a business is owed by its customers for goods and services that have been delivered but have not yet been cleared. In addition to impacting your business’s liquidity and financial health, it represents money that will eventually be collected. By managing AR effectively, you will ensure timely payments, reduce late fees, and maintain positive relationships with your customers.

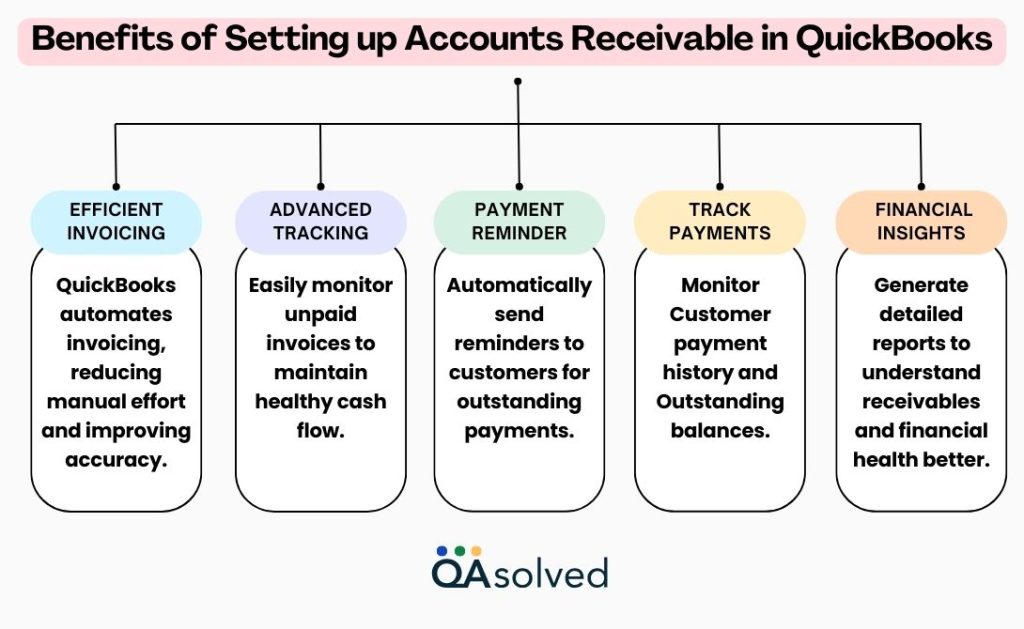

QuickBooks plays a crucial role in simplifying and automating the management of accounts receivable. It makes it easy to create and send invoices, track outstanding payments, set up automatic payment reminders, and generate reports that provide insights into your cash flow and aging accounts. Additionally, QuickBooks helps you stay on top of overdue invoices and manage receivables efficiently by categorizing and reconciling payments. In short, QuickBooks simplifies and organizes tracking and collecting payments for small or large businesses, giving you greater control over your finances.

What does Accounts Receivable Means?

Now, let’s look at two key ratios for measuring and tracking your accounts receivable:

What is the Accounts Receivable Turnover Ratio?

The accounts receivable turnover ratio is a financial metric that assesses how efficiently a company collects payments from its customers within a specific accounting period. This is also known as the “receivable turnover” or “debtors turnover” ratio.

The formula for calculating the accounts receivable turnover ratio for one year is as follows:

Accounts Receivable Turnover Ratio = Net Credit Sales/Average Accounts Receivable

Current Ratio: This financial metric, often referred to as working capital, serves as an indicator of a company’s liquidity. It assesses the company’s capability to meet short-term financial obligations using readily available cash or other liquid assets that can be converted into cash within one year.

Working Capital Ratio = Current Assets/Current Liabilities

Days Sales Outstanding (DSO): This metric reveals the average duration it takes for your customers to settle payments for the goods and services provided by your company.

Days Sales Outstanding = Accounts Receivable for a Given Period/Total Credit Sales X Number of Days in the Period

In this ratio, you can see how often an organization collects its average accounts receivable balance. Higher ratios indicate that receivables are being collected more quickly, which is generally positive.

Industry-specific turnover ratios vary. Restaurants and grocery stores, for instance, receive immediate payment through cash or credit cards. However, companies selling bulk or high-ticket items may experience longer payment cycles, sometimes extending for months. Comparing your turnover ratio with others in your industry can help you gauge your performance.

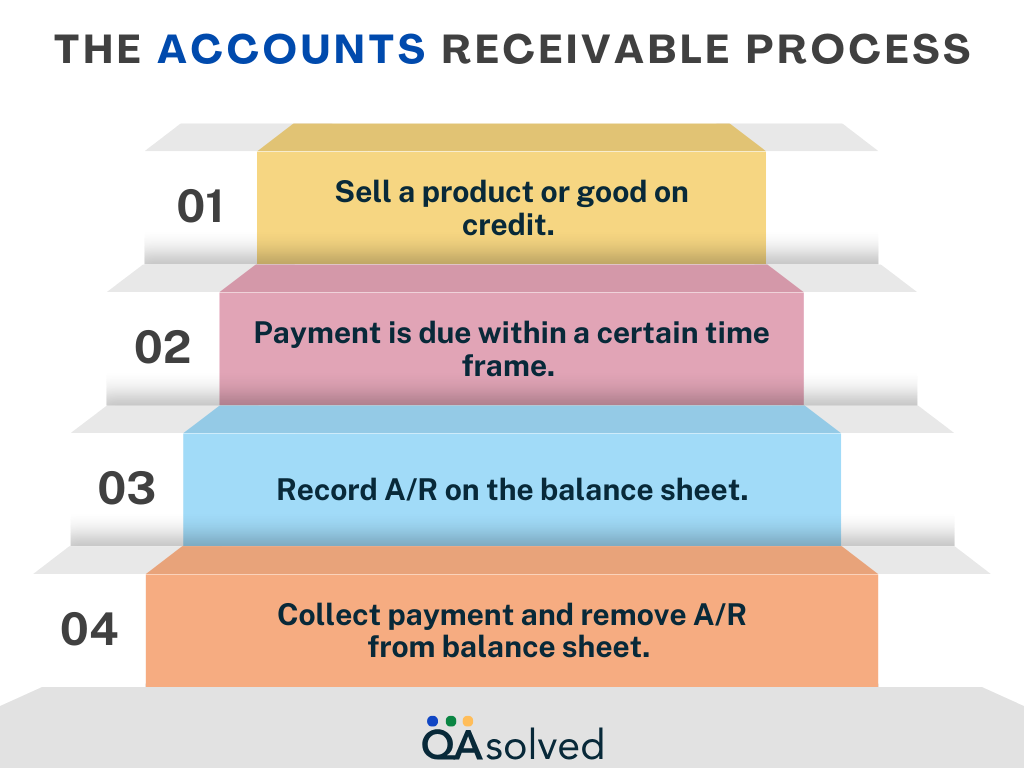

Steps to Set up Accounts Receivables in QuickBooks

Given below are the steps to set up accounts receivables in QuickBooks:

A. Allow for an Estimate of the Total Cost of Goods and Services

- Log into QuickBooks as an administrator.

- Go to Edit and select Preferences.

- In the Company Preferences section, click on Jobs & Estimates.

- Select ‘Yes’ when prompted with “Do you need to create estimates?”

- Click ‘OK’ to finish the process.

B. Creation of the Estimate Value

- Select ‘Create Estimates‘ from the Customers menu.

- Enter the necessary details for the customer or job you selected.

- Provide information about the sale items or services.

- To finish, click ‘Save and Close‘.

C. Creation of Sales Order

- Choose Preferences from the Edit menu.

- Select Sales and Customers, then click on Company Preferences.

- Click ‘OK’ to enable Sales Orders.

- Select the Customers menu, then click ‘Create Sales Order‘, fill out the required details.

- Finally enter ‘Save and Close‘.

D. Creation of Invoice

- Click on New Invoice under the Create menu.

- Then choose ‘Create an Invoice from Sales Order/Estimate‘.

- Hit ‘Save and Close’ to complete the process.

E. Tracking of Payment

- Go to the homepage and select ‘Receive Payments.’

- Select the customer making the payment next.

- Enter the necessary information, such as the amount, date, etc.

- To record a check payment, enter the check number.

- Select the invoice to apply the payment to.

- Once all details are entered, you can add a memo if necessary, which will provide more clarity.

- To complete the process, click ‘Save and Close.

F. Creation of Deposit

- Select ‘Banking’ from the left navigation panel on the home screen.

- Choose ‘Record Deposit‘ or ‘Make Deposit‘.

- Select the payments to be deposited.

- Decide which bank account to deposit funds into.

- Enter the required details.

- Select ‘Save and Close‘ to finish.

Managing your accounts receivable (AR) allows you to keep track of the funds that are owed to your business by customers or third parties. Keeping track of AR in QuickBooks is simple and efficient, helping you maintain comprehensive sales and customer reports.

Steps to Add Tracking for Accounts Receivable in QuickBooks

Keeping track of accounts receivable (AR) is crucial to maintaining accurate financial records and ensuring timely payments. QuickBooks’ AR tracking feature allows you to keep a close eye on outstanding invoices and improve cash flow management. Here, we’ll walk you through the steps to set up and track accounts receivable within QuickBooks so you can stay on top of your customer payments.

A. Customer Information Added

- Go to the Customer Center in QuickBooks.

- From the menu, click on New Customer & Job.

- In the Customer Name field, enter the name of the client.

- Enter the client’s unpaid balance in the Opening Balance and As of fields. If you’re tracking multiple jobs for the same customer, leave these fields blank and update the balance when creating a new QuickBooks Job entry.

- Include any additional information, such as the customer’s address, phone number, and sales tax information.

- When you are done adding information, click Next to save, or OK to finish saving.

B. Adding a Receivables Account

- Go to the Lists and select the Chart of Accounts to activate QuickBooks.

- Then click on New under the Account section.

- Select Accounts Receivable (A/R) and click Continue.

- Enter the account name in the Account Name field. In the Number field, you may also include the account number.

- Click Next to save and create a new account, or OK to save and close the current account.

Steps to Add the Customer Information in QuickBooks

- Sign in to QuickBooks.

- Select Customer Center from the Customers menu or click on the link Customer Center.

- Then select New Customer & Job from the top menu.

- Enter the Customer Name.

- Depending on the situation, enter the Opening Balance and As of date.

- Add any optional details, such as your address, phone number, and email address.

- When finished, click OK to save and finish adding another customer.

Adding an Accounts Receivable Account

- Choose Chart of Accounts from the Lists menu in QuickBooks.

- Then click Account, select New, and select Accounts Receivable.

- Provide the account number and name (if available).

- Alternatively, click OK to save and exit.

With this simple setup, not only can you manage customer accounts more efficiently, but your financial records will stay up-to-date as well. You’re now ready to take full advantage of QuickBooks’ features for smooth and accurate business operations.

How to Manage Account Receivables with QuickBooks?

QuickBooks offers a range of tools for managing accounts receivable, from creating invoices and sending them to tracking payments and managing overdue accounts. You can easily monitor outstanding balances, generate overdue payment reminders, and streamline the entire AR process with its user-friendly interface. Whatever your client base, QuickBooks makes it easy to maintain a healthy cash flow and collect payments promptly. This section will guide you through using QuickBooks to effectively manage your accounts receivable.

- Establish Credit Policies: The initial step is setting up your credit management process. Before extending credit to customers, assess their creditworthiness & their ability to make timely payments. QuickBooks Online accounts receivables can assist in automating and tracking these assessments.

- Invoice Generation: Issue and generate invoices for the provided goods or services. Make sure that invoices are accurate and detailed to avoid confusion or disputes. Simplify and streamline the invoicing process by integrating with QuickBooks.

- Payment Collection: After sending invoices, focus on collecting payments efficiently. Accept payments through various methods, but integrating QuickBooks into accepting payments can expedite the process and enhance customer convenience.

- Address Overdue Payments: Establish a clear resolution for managing past-due payments and disputes. Maintain open communication with customers to address their concerns and resolve issues promptly. QuickBooks Online accounts receivable can help you track and manage these interactions effectively.

- Conduct Regular Reconciliation: Consistently reconcile payments with outstanding invoices to identify discrepancies or overdue accounts. Record each payment in your accounting system to keep your financial records accurate and updated.

By following the above-mentioned approaches, you can ensure efficient accounts receivable management and maintain healthy cash flow.

Conclusion

Accounts receivable should be closely monitored by businesses in order to avoid cash flow issues that impede day-to-day operations. QuickBooks Online can streamline the AR process by tracking invoices, sending automated payment reminders, and producing detailed reports to help you stay on top of your finances. QuickBooks helps you manage accounts receivable, improve cash flow, and ensure timely collections.

QuickBooks simplifies managing accounts receivable with its powerful features, which are essential for maintaining a healthy cash flow. You can track payments, generate invoices, send reminders, and analyze aging reports with QuickBooks. Manage your accounts receivable with QuickBooks to gain better control over your finances, reduce the risk of late payments, and ensure that your business runs smoothly. You can make more informed financial decisions and focus on growing your business when you have everything in one place. If you require any further information or have any questions, don’t hesitate to get in touch with us. We’re here to help!

Frequently Asked Questions

Accounts Receivable refers to money owed to a business by its customers, while Accounts Payable refers to money a business owes to its suppliers or creditors.

To set up AR, ensure that you have created customer profiles and assigned proper terms and conditions for credit sales. Also, you can customize invoices and set up reminders for overdue payments.

Navigate to the “+ New” button and choose “Invoice” Mention customer details, product descriptions, quantities, prices, etc. Save & send the invoice directly from QuickBooks.

QuickBooks tracks pending invoices and sends timely payment reminders through automation. You can also see a detailed report on pending balances and manage follow-up actions.

It measures the efficiency of businesses collecting pending payments with the help of detailed financial reports generated through QuickBooks that calculate the ratio between sales and receivable balances.