Integrating ADP with QuickBooks can significantly transform how you manage your payroll and accounting by automating data transfer and greatly minimizing costly manual errors. Whether you run a small business or are rapidly scaling up, this powerful integration ensures that employee wages, tax withholdings, and deductions are accurately recorded directly into QuickBooks with no extra manual data entry required.

ADP, one of the most trusted and widely used payroll services, expertly manages salary calculations, tax filings, and compliance, while QuickBooks serves as a robust and comprehensive platform to track your business’s overall financial health and cash flow. By seamlessly connecting the two systems, your payroll data flows effortlessly into your accounting software, keeping your financial records accurate, up-to-date, and audit-ready. This integration not only saves you valuable time but also enhances your reporting capabilities for taxes, audits, and informed internal decision-making.

In this detailed blog post, we’ll guide you step-by-step through the entire process of integrating ADP with QuickBooks, covering both QuickBooks Online and Desktop versions. So, let’s begin with it.

What is Meant by ADP?

ADP stands for Automatic Data Processing, a leading global provider of human resources (HR) management software and comprehensive services. It delivers solutions for payroll, benefits administration, and workforce management.

ADP is a robust suite of tools that simplifies and automates various HR functions, enabling businesses to handle payroll, employee benefits, time tracking, and compliance with greater efficiency. With user-friendly platforms that offer real-time workforce insights, ADP empowers organizations to make informed decisions and improve overall productivity.

Committed to security, ADP safeguards sensitive employee data, giving both businesses and their staff confidence and peace of mind. Backed by extensive industry expertise and a proven history of success, ADP stands as a trusted partner for companies of all sizes and remains a leading force in the HR technology space.

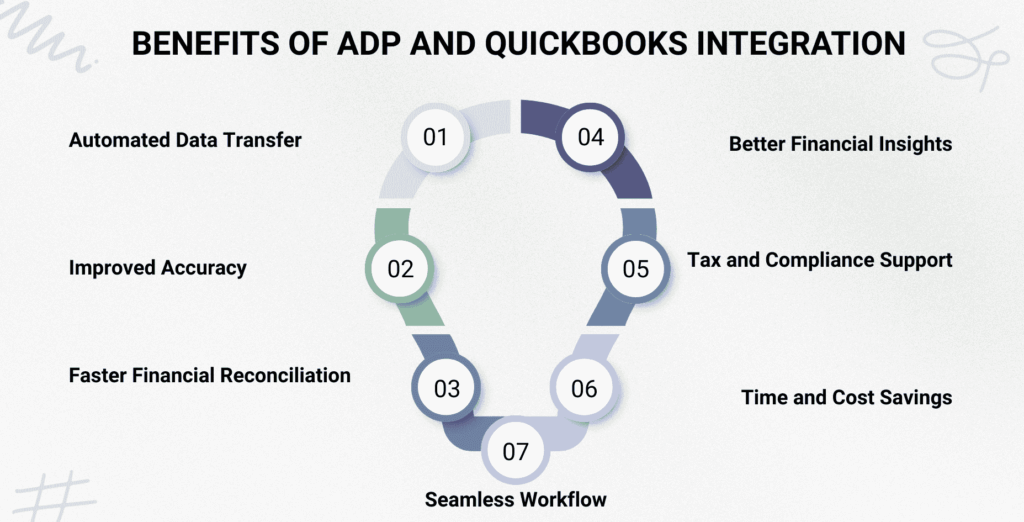

Top 7 Benefits of ADP and QuickBooks Integration

The ADP and QuickBooks integration has several key benefits for businesses looking to streamline payroll and accounting:

- Automated Data Transfer: ADP payroll data is automatically synced with QuickBooks, reducing manual entry and saving you time.

- Improved Accuracy: This integration helps prevent costly payroll and accounting errors by eliminating duplicate data entry.

- Faster Financial Reconciliation: Reconciling accounts becomes more efficient and accurate with real-time payroll data flowing into QuickBooks.

- Better Financial Insights: Payroll information improves financial reporting and enables smarter budgeting and forecasting.

- Tax and Compliance Support: Assures payroll records are maintained accurately so tax filings can be filed and regulatory requirements can be met.

- Time and Cost Savings: When you automate payroll processes, you will have more time and resources to focus on growing your company.

- Seamless Workflow: Integrating ADP’s payroll and HR tools with QuickBooks’ accounting system enables unified business processes.

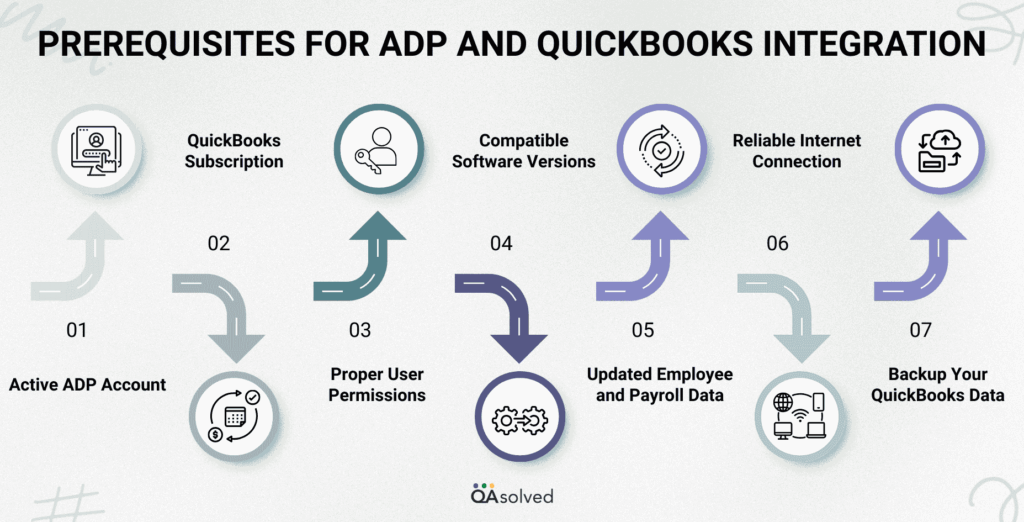

Prerequisites for ADP and QuickBooks Integration

Before you begin integrating ADP with QuickBooks, there are a few essential prerequisites to ensure a smooth and successful setup. Preparing your accounts, verifying software versions, and having the necessary permissions in both platforms will help prevent common issues during the integration process. In this section, we’ll cover the key requirements and steps you should complete beforehand to set the foundation for a seamless connection between ADP and QuickBooks.

- Active ADP Account: You need an active and fully set-up ADP payroll account with access credentials. Ensure your ADP plan supports integration with third-party accounting software.

- QuickBooks Subscription: Have an active QuickBooks Online or QuickBooks Desktop account. Verify your QuickBooks version supports ADP integration or third-party sync tools.

- Proper User Permissions: Ensure you have administrative or sufficient user permissions in both ADP and QuickBooks to enable integration and data syncing.

- Compatible Software Versions: Confirm that your QuickBooks software version is compatible with ADP’s integration capabilities. Regularly update your QuickBooks software for best performance.

- Updated Employee and Payroll Data: Make sure your employee information and payroll data in ADP are accurate and up to date to avoid syncing errors.

- Reliable Internet Connection: A stable internet connection is necessary for real-time data syncing between ADP and QuickBooks.

- Backup Your QuickBooks Data: Before starting the integration, create a backup of your QuickBooks data to prevent data loss in case of any issues.

Small and growing businesses can benefit from QuickBooks and ADP integration by simplifying financial management and improving operational efficiency. Connect ADP to QuickBooks Online to automate payroll and accounting processes and sync employee wages, taxes, and deductions.

What Data Can Be Synced Between ADP and QuickBooks?

Payroll and employee data can be synced between ADP and QuickBooks when the two systems are integrated. This ensures accurate bookkeeping and streamlines financial management. Typically, you can sync the following:

- Payroll Summaries – Gross pay, net pay, and tax withholdings.

- Employee Information – Names, job titles, departments, and ID numbers.

- Wage Details – Regular wages, bonuses, commissions, and overtime.

- Tax Payments – Federal, state, and local payroll tax withholdings.

- Deductions & Contributions – Benefits, retirement plans, garnishments, etc.

- General Ledger Entries – Payroll-related accounting data mapped to specific QuickBooks accounts.

- Pay Period & Payroll Dates – Ensures proper syncing of pay periods for reporting.

Note: Data sync may vary depending on ADP version (e.g., RUN, Workforce Now) and integration method (e.g., ADP Marketplace app or manual imports).

Steps to Integrate ADP with QuickBooks Online and Desktop

Setting up the connection between ADP and QuickBooks can greatly improve the accuracy of your payroll and bookkeeping. During this section, we’ll walk you through the essential steps needed to ensure smooth payroll data flow into your accounting system using ADP QuickBooks integration. Following these steps will simplify payroll tracking and reporting, regardless of whether you use QuickBooks Online or Desktop.

Step 1: Log in to ADP and QuickBooks

It is essential that you have both an active ADP and QuickBooks account before you start the integration process. The steps are as follows:

- ADP RUN: Sign in to your ADP RUN Payroll account with your login credentials.

- QuickBooks: Then, log in to your QuickBooks account. If you’re using QuickBooks Online, confirm that you have administrative permissions to handle integrations.

Step 2: Install the ADP QuickBooks Connector

- Open your ADP account and go to the ADP Marketplace.

- Use the search bar to find the QuickBooks integration app or connector.

- Click on the app and follow the installation prompts.

- If the app isn’t free, you may need to complete a purchase to proceed.

Step 3: Authorize Integration

- Access QuickBooks and go to the Apps section.

- Search for the ADP RUN app.

- Use your ADP login credentials to authorize access to the app.

- Make sure you confirm any permission prompts to ensure QuickBooks and ADP are connected securely.

Step 4: Match Payroll Data Fields

- Select General Ledger settings from your ADP account.

- Set up QuickBooks accounts for each payroll item (such as wages, taxes, and deductions).

- Make sure your payroll records are mapped correctly to avoid errors and mismatches.

Step 5: Set Up Synchronization Preferences

It is possible to tailor how data flows between ADP and QuickBooks by adjusting your sync settings.Choose whether to sync payroll data manually or automatically. Set preferences for payroll frequency, pay period dates, and other details. To ensure smooth and accurate payroll integration, ensure these configurations match your business needs.

Step 6: Verify the Integration Setup

To ensure everything is working properly, you should run a test before implementing the integration.

- Analyze a sample payroll in ADP and ensure the data is accurately transferred to QuickBooks.

- Verify that QuickBooks entries are mapped and reported correctly.

- Before going live, adjust your settings or contact support for assistance.

Step 7: Go Live

Upon confirming that the test has been successful, you can begin implementing the system fully.

- ADP can help you process your routine payroll.

- Ensure payroll data is transferred correctly into QuickBooks during the initial syncs.

- Regularly review financial reports in both platforms to ensure accuracy and resolve issues as soon as possible.

- Payroll and bookkeeping can be simplified through this integration, allowing your business to focus on bigger priorities and reduce manual labor.

After completing these steps, your payroll and accounting systems are now seamlessly connected. ADP integration with QuickBooks reduces manual data entry, minimizes payroll errors, and streamlines the process of maintaining accurate financial records. Keep an eye on your sync settings and reports to ensure that both platforms are aligned and accurate.

Also Read: Import Employees and Pay History from ADP, Gusto or Paychex into QuickBooks Online Payroll?

Summary

Integrating ADP with QuickBooks can transform the way your business handles payroll and accounting. Having the two systems connected eliminates manual data entry, reduces human error, and ensures that your payroll expenses and liabilities are accurately reflected in your financial statements. With ADP and QuickBooks integration, payroll data such as employee wages, taxes, deductions, and benefits can be synced seamlessly into QuickBooks, saving both time and effort.

The integration also enhances compliance and audit readiness by maintaining well-organized records across platforms. Payroll posting and financial reconciliation can be automated, allowing growing businesses to focus on strategic planning, employee management, and customer service rather than payroll administration.

Keeping track of sync settings, reviewing financial reports, and periodically testing the integration ensure long-term reliability. Accounting and payroll processes become smoother, more transparent, and scalable when your ADP and QuickBooks connection is configured correctly.

Frequently Asked Questions

ADP QuickBooks Desktop integration helps streamline payroll and accounting processes by automatically transferring payroll data – including wages, taxes, and deductions – from ADP to QuickBooks Desktop. It minimizes errors, reduces manual data entry, and ensures accurate and up-to-date financial records. Directly syncing payroll details can simplify tax reporting, save time on reconciliations, and maintain cleaner, more organized records.

Yes, QuickBooks Online Payroll has a feature called Auto Payroll that can run payroll automatically. It allows you to automate payroll without having to manually intervene.

Set Up Scheduled Payroll (if not already set up):

1. Go to Employees > Payroll Center.

2. Click the Pay Employees tab.

3. Start Scheduled Payroll or Create Pay Schedules if you do not already have one.

4. Add details like employee list, start date, and pay frequency.

Run Scheduled Payroll:

1. Go to Employees > Pay Employees > Scheduled Payroll.

2. Click on Start Scheduled Payroll to begin the payroll process.

3. Review or enter hours worked for each employee.

4. Check pay rates, deductions, and taxes.

5. Then click Create Paychecks.

6. Select either Print Paychecks or Direct Deposit.

7. Hit Finish Payroll.

Check your login credentials, verify that your account access permissions are set correctly, and make sure that your integration app is properly installed on your computer. If you continue to experience problems with your field mapping, you should contact ADP or QuickBooks technical support for assistance.