January is here, and before we could act, the calendar flipped to 2025. This time of year signals the need to complete essential financial tasks, with payroll taking center stage. Payroll season isn’t just another item on the checklist for businesses, it’s a crucial process that ensures financial accuracy, tax compliance, and a strong foundation for the year ahead. In the new fiscal year, getting it right can save you time, avoid penalties, and give you more confidence. To get a clear and accurate picture of your business’s financial health, think of your payroll year-end as a big jigsaw puzzle. If you miss even one step, you could face costly errors, compliance issues, or a rough start to the year. That’s why you need a well-structured year-end checklist.

QuickBooks Desktop Payroll is a reliable tool that helps businesses simplify their payroll processing. But even the most effective tools require a systematic approach to ensure nothing falls through the cracks. Year-end preparation involves more than just tallying numbers, it includes validating employee information, reconciling payroll data, and verifying tax filings. Moreover, preparing and filing W-2 forms on time and reconciling tax liabilities is crucial to maintaining trust with employees and authorities.

The article walks you through how to verify employee details, reconcile wages, and prepare for tax filing to check off your to-do list. Let’s dive in and take the stress out of year-end payroll preparation!

Preparing for 2025: Year-End Payroll Checklist for QuickBooks Desktop

Note: This checklist applies to QuickBooks Desktop Payroll Basic and Enhanced users.

The months of December and January are crucial to every business, packed with essential tasks such as filing taxes and providing employees with W-2s. Keep track of these key payroll dates and tasks for year-end.

December 27, 2024

Run Final Payroll for 2024

- Confirm employees wages and benefits are accurate.

- The final paychecks and bonuses should be deposited by 5:00 p.m. PST.

- Keep track of all employee paychecks, such as handwritten checks, commissions, terminations, and bonuses.

- If necessary, report company-paid healthcare on your employees’ W-2 forms.

- Add any earned commissions to employee pay records.

- Contribute to your employees’ retirement as required.

Order Year-End Supplies

- Get W-2 printed forms and envelopes.

- Keep up with regulatory changes by subscribing to labor law compliance posters.

Before the First Payroll of 2025

Provide employees with online access to their W-2s

- Allow your employees to access their W-2s and pay stubs online with QuickBooks Workforce.

Check and Update Employee Details

- Ensure that your QuickBooks is up-to-date with the latest payroll update.

- Confirm employee details including SSNs, legal names, and addresses.

- Review and update employees’ W-4s and state withholding forms.

- Make sure your federal deposit and filing schedule is up to date.

- Examine both used and unused vacation hours.

Review and update company information

- Run year-end reports that cover employee data, tax information, and wage summaries.

- State unemployment insurance rates should be updated.

- It is important to confirm and modify the official address and name of your company.

Read More: How to Print W-2 in QuickBooks Desktop and Online?

January 27, 2025

Prepare and file payroll tax forms and payments

- File state forms and make tax payments, keeping in mind that forms, due dates, and lead times vary by state.

January 29, 2025

- Your W-2 forms should be e-filed with Social Security.

- File your W-2 forms electronically with your state (processing times may vary).

- Complete any tax payments and submit federal forms such as 941/944 or 940.

Before January 31, 2025

- Make sure your 1099s are e-filed in advance so they are processed and mailed to your contractors by January 31.

January 31, 2025

- Make sure your employees receive their W-2 forms.

- E-file your 1099-NEC if you haven’t already done so to ensure timely submission to the IRS.

February 28 and March 31, 2025

- 1099-MISC forms must be submitted to the IRS by February 28. IRS 1099-MISC forms must be e-filed by March 31.

Also Read: How to Create and File 1099s with QuickBooks Online?

Benefits of Preparing the Year-end checklist for QuickBooks Desktop Payroll

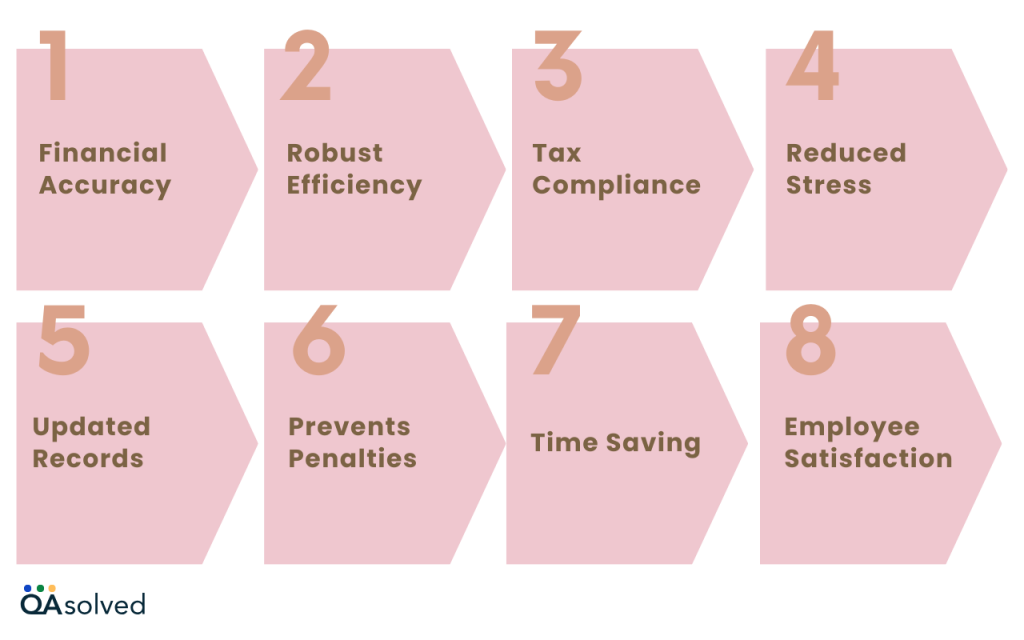

The Year-End Checklist for QuickBooks Desktop Payroll offers several benefits:

- Financial Accuracy: Reduces errors and penalties by ensuring accurate employee details, payroll, and tax forms.

- Robust Efficiency: Simplifies year-end tasks like filing taxes and generating reports.

- Tax Compliance: Ensures that IRS and state deadlines are met, avoiding late fees and audits.

- Reduced Stress: The time has come to bid farewell to stress-related tasks because it can also organize your schedule and prevent last-minute rushes.

- Updated Records: Maintaining the accurate record has become one of the prime objectives of businesses and with the help of an year-end checklist in QBD Payroll, one can maintain accurate information about employees and taxes.

- Prevents Penalties: Another benefit is that while submitting the W-2s, 1099s, and other tax forms, businesses can prevent themselves from hefty fines and penalties.

- Time Saving: Preparing a year-end checklist for QuickBooks Desktop Payroll also reduces a significant amount of time spent on finding mistakes and resolving them.

- Employee Satisfaction: Provides accurate and timely form distribution for better transparency with employees.

So, these are the crucial steps that can help you maintain your financial records easily and by following the checklist, you can prepare your payroll system for the upcoming year without worrying about the last minute tussle.

Wrapping Up

As a result, completing the Year-End Checklist for QuickBooks Desktop Payroll is a vital step in ensuring a smooth transition to the new year while maintaining tax compliance. By reviewing and updating employee information, running year-end reports, and ensuring payroll tax forms are accurate and filed on time, you can safeguard your business from potential errors or penalties. In addition, making sure W-2s are distributed properly and 1099 forms are filed on time sets the foundation for the year ahead.

To keep your records current and minimize any issues with government or state agencies, you must update your company’s legal name, address, and tax rate on time. Following this checklist will ensure that all payroll tasks are completed accurately and efficiently, leaving you with peace of mind as you close out the year.

Frequently Asked Questions

By using the year-end checklist, you can ensure all payroll tasks are completed correctly before the end of the year, such as filing taxes and preparing W-2s for employees.

Update employee details, such as names, addresses, and Social Security numbers, in QuickBooks Desktop’s Employee Center.

QuickBooks Desktop’s Payroll Summary report allows you to adjust discrepancies between your payroll records and the year-to-date amounts.

Update QuickBooks Desktop and payroll tax tables to stay in compliance with new tax rates and regulations.