Introducing QuickBooks Solopreneur, Intuit’s latest innovation designed to make finances easier for independent business owners. This all-in-one product offers extensive features to help solo entrepreneurs handle their finances, set trackable goals, manage expenses for tax preparation, and gain financial stability with ease.

With the gig economy on the rise, more people are diving into entrepreneurship, attracted by its freedom and flexibility. Yet, for solopreneurs, staying on top of finances can be daunting, pulling attention away from business growth. QuickBooks Solopreneur seeks to ease these burdens by offering a simplified financial management platform designed specifically for independent business owners.

Individuals running their businesses can use QuickBooks Solopreneur whether they employ 1099 contractors or not. It provides intuitive tools for organization, tax management, and fostering growth to strengthen financial stability. Once you link your bank or credit card account, QuickBooks Solopreneur automatically sorts transactions into predefined categories for effortless review. Its tax filing features are specifically crafted for “Schedule C” (Form 1040) filers, applicable to sole proprietors or single-member LLCs.

Key Features of QuickBooks Solopreneur Include:

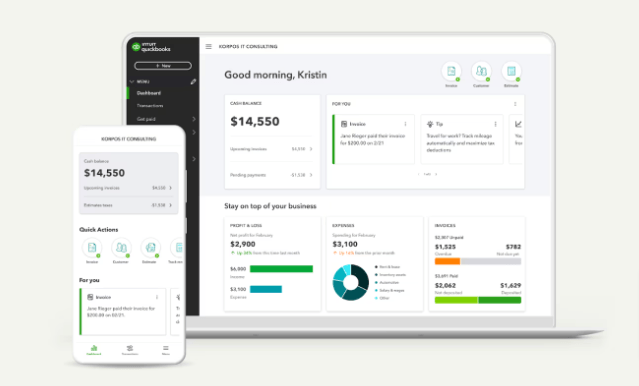

- Manage all your finances in one location: Access tools that automatically categorize business and personal transactions for easy review, link bank accounts, and import spreadsheet data for a comprehensive overview of your operations. Additionally, effortlessly track mileage, create customized invoices and estimates, view reports, and more.

- Use tools and insights to make informed decisions: Track revenue, expenditures, and profitability through comprehensive reports and dashboards, providing real-time control over cash flow. Additionally, set and track goals, get insight, and receive suggestions to reach your objectives.

- Simplify tax time: Stay prepared throughout the year with tools that automatically track mileage using the QuickBooks mobile app*, and easily classify business trips for accurate tax deductions. You can smoothly transition from managing your books to filing taxes directly within QuickBooks, and access expert assistance through QuickBooks Live Assisted Tax, powered by TurboTax, to confidently file your taxes

As said by Michael Hitchcock, Vice President, Accounting and Tax QuickBooks at Intuit. “Many solopreneurs are at that critical phase where they need to better understand their business to chart a path to financial stability. QuickBooks Solopreneur is designed specifically for one-person businesses that crave simplicity and don’t yet require an advanced accounting solution. It enables them to get a holistic view of their finances, manage daily operations, and be ready for tax time so they can grow on their terms.”

Moreover, in the coming time, QuickBooks Solopreneur will deliver a better experience across the QuickBooks platform to meet the changing needs of solo entrepreneurs. This includes transitioning to QuickBooks Online and accessing other QuickBooks tools and services.

QuickBooks Solopreneur is now available online for customers in the U.S. It’s also compatible with the QuickBooks mobile app on iOS and Android devices.

Pricing:

| QuickBooks Solopreneur |

|---|

| Starts at $10/Mon 30 Days Free Trial |