In today’s business landscape, financial trust is everything. Whether it’s a public company raising capital or a multinational navigating global markets, reliable financial reporting determines how much confidence investors, regulators, and stakeholders place in an organization. In the United States, this trust is safeguarded by Generally Accepted Accounting Principles (GAAP). GAAP in accounting refers to a comprehensive set of accounting principles and standards issued primarily by the Financial Accounting Standards Board (FASB) and enforced by the Securities and Exchange Commission (SEC).

Being a rule-based framework that has been the foundation of financial reporting for decades in the United States, GAAP has become more than a regulatory requirement. It is shaping how businesses compete, access capital, and maintain credibility in a globalized economy. While GAAP is a strict requirement for publicly traded companies under the watchful eye of the FASB and SEC, it’s not just Wall Street giants that follow these standards.

Thousands of private businesses, startups, and even nonprofits voluntarily adopt GAAP because it signals transparency, accountability, and consistency to their stakeholders. In simple terms, GAAP acts like a universal financial “language” that tells investors, lenders, and donors, “You can trust our numbers.”

If you’re eager to get a clear picture of Generally Accepted Accounting Principles, then you’ve landed in the right place. In this blog, we’ll walk you through the essentials, simplify the jargon, and even reveal some of the best GAAP accounting software that businesses are relying on today.

Importance of GAAP Compliance in Today’s Dynamic Business Landscape

For American organizations, GAAP is not just about satisfying regulators. It’s about enhancing transparency, protecting reputation, and unlocking long-term growth opportunities in a world where financial integrity is the ultimate currency. Here are some of the key aspects that are driving the relevance of GAAP compliance for businesses today.

1. Builds Investor Confidence

GAAP-compliant financial statements give investors consistent, reliable insights. Following GAAP accounting rules reassures stakeholders that reported numbers are accurate, transparent, and aligned with recognized standards of trust and credibility.

2. Ensures Regulatory Compliance

Public companies must adhere to GAAP accounting rules, but even private firms benefit. GAAP compliance minimizes legal risks, prevents penalties, and keeps businesses aligned with the U.S. Securities and Exchange Commission’s expectations.

3. Simplifies Access to Capital

Lenders and investors often require GAAP-compliant financial statements before approving funding. By adopting GAAP, companies demonstrate accountability and financial discipline, which helps unlock financing opportunities and improves borrowing terms.

4. Supports Better Decision-Making

GAAP accounting rules standardize how revenues, expenses, and assets are recorded. This consistency allows management teams to compare results across periods and competitors, leading to smarter decisions for long-term growth.

5. Strengthens Credibility with Stakeholders

From suppliers to donors, GAAP-compliant financial statements show a commitment to transparency. Nonprofits and startups often adopt GAAP voluntarily to build credibility and strengthen trust with diverse stakeholders.

6. Leverages Technology for Accuracy

Modern GAAP accounting software automates compliance tasks, reduces manual errors, and simplifies reporting. Using the right tools ensures accuracy, saves time, and keeps financial reporting aligned with GAAP standards.

7. Enhances Global Competitiveness

While IFRS dominates internationally, U.S. companies benefit by keeping financials GAAP-compliant. Accurate reporting improves cross-border credibility, supports investor relations, and prepares businesses for potential convergence with international standards.

In short, compliance with GAAP in accounting helps companies meet legal obligations while avoiding penalties and reputational risks.

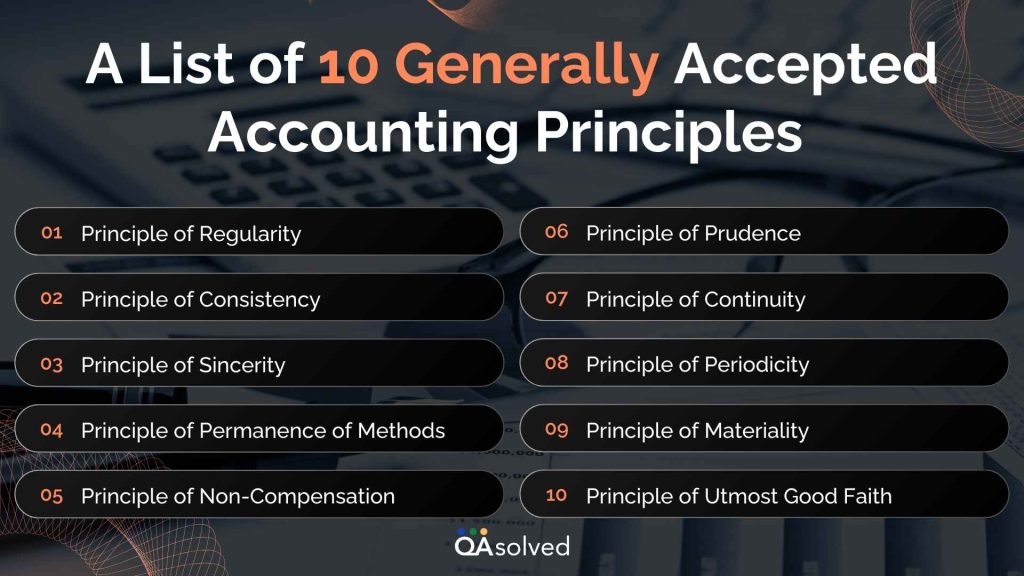

A List of 10 Generally Accepted Accounting Principles

The foundation of GAAP in Accounting is built on ten core principles. These GAAP accounting rules guide transparency, consistency, and integrity in financial reporting, ensuring businesses maintain credibility and trust. Here’s a list of 10 Generally Accepted Accounting Principles:

1. Principle of Regularity

GAAP in accounting is all or nothing. If your business claims compliance, then every financial operation and report must strictly follow the established GAAP accounting rules without any exceptions.

2. Principle of Consistency

Once an accounting method is chosen, it should be applied consistently across all reporting periods and statements. If a change becomes necessary, it must be clearly documented and fully explained in the notes.

3. Principle of Sincerity

Honesty is non-negotiable in financial reporting. Accountants must always ensure that GAAP-compliant financial statements reflect an accurate, reliable, and unbiased picture of the company’s true financial health at all times.

4. Principle of Permanence of Methods

This principle emphasizes consistency in how information is presented. GAAP in accounting requires reports to maintain the same structure and format, making it easier to compare company performance over time.

5. Principle of Non-Compensation

GAAP accounting rules require businesses to present both positive and negative information openly without offsetting it. Losses cannot be hidden by gains, and debts cannot be disguised or masked by assets.

6. Principle of Prudence

Speculation has no place in GAAP in accounting. Financial statements must be based only on verifiable, reliable data and real numbers, not forecasts, guesses, or assumptions made for planning purposes.

7. Principle of Continuity

Even if a business is struggling financially or planning to close, GAAP in accounting requires that reports be prepared under the assumption that operations will continue into the future.

8. Principle of Periodicity

Financial reports must be issued on a consistent, reliable schedule, typically quarterly or annually. Each GAAP-compliant financial statement should include only transactions relevant to that specific reporting period.

9. Principle of Materiality

Accountants are expected to be thorough and ensure all significant financial details are disclosed. Under GAAP accounting rules, this includes valuing assets accurately and ensuring that no significant facts are omitted.

10. Principle of Utmost Good Faith

Ethics are at the heart of GAAP in accounting. Everyone preparing or reviewing financial reports must act with honesty, integrity, transparency, and good faith in every financial transaction.

So, these are the ten most crucial principles that businesses must abide by to keep their numbers accurate and transparent. But who all needs to follow the U.S. GAAP? Well, let’s take a look at that too.

Who Has to Prepare GAAP-Compliant Financial Statements?

GAAP in accounting isn’t limited to large corporations alone. Different types of organizations rely on these standards to ensure transparency, accuracy, and trust in their financial reporting. Here’s a breakdown:

1. Private Companies

Although private companies are not legally obligated to follow GAAP accounting rules, many adopt them voluntarily. Doing so helps build credibility with investors, lenders, and potential partners, making it easier to secure funding and business opportunities.

2. Public Companies

All publicly traded companies in the United States are legally required to prepare GAAP-compliant financial statements. The Securities and Exchange Commission (SEC) enforces this mandate to protect investors and maintain market integrity.

3. Nonprofit Organizations

Nonprofits and charitable institutions are also expected to comply with GAAP in accounting or equivalent standards. This ensures transparency in financial reporting, strengthens donor confidence, and fulfills regulatory obligations tied to nonprofit operations.

No wonder companies are focused on staying compliant with Generally Accepted Accounting Principles. But the real question is how can a business ensure it meets all US GAAP requirements? Well, let’s take a look.

7 Ways to Remain US GAAP-Compliant

For businesses, finance professionals, and accountants, adhering to US Generally Accepted Accounting Principles (GAAP) is essential for accurate and trustworthy financial reporting. Non-compliance can lead to errors, audits, or even legal issues. Here are practical steps to ensure your organization remains fully compliant.

1. Implement Internal Controls

Strong internal controls help prevent errors, fraud, and misstatements in financial reporting. By establishing clear approval processes, segregation of duties, and regular reconciliations, your organization can maintain accurate financial records and stay aligned with GAAP requirements.

2. Document Accounting Policies and Procedures

Maintaining a written manual of accounting policies and procedures ensures consistency and transparency across your organization. This documentation serves as a reference for your team, supports audits, and demonstrates your commitment to GAAP compliance.

3. Stay Updated with FASB Guidelines

The Financial Accounting Standards Board (FASB) regularly updates US GAAP standards. Make it a habit to review these updates to ensure your accounting practices align with the latest requirements. Staying informed helps prevent errors and ensures your financial statements remain accurate and credible.

4. Work with Certified Public Accountants (CPAs)

When in doubt, hiring a CPA or accounting firm is one of the most effective ways to ensure compliance. Experienced accountants can review your financial reports, advise on complex transactions, and provide peace of mind that your reporting meets all US GAAP requirements.

5. Conduct Regular Audits

Scheduling periodic external audits helps verify that your financial records comply with GAAP standards. Auditors can identify discrepancies, suggest improvements, and confirm that your reporting practices remain transparent and accurate.

6. Train Your Accounting Team

Your accounting team plays a critical role in maintaining compliance. Provide regular training and updates on US GAAP principles to ensure your staff is knowledgeable about current standards and best practices. A well-trained team reduces errors and strengthens your overall financial reporting process.

7. Use US GAAP-Compliant Accounting Software

Investing in accounting software designed for US GAAP compliance, such as QuickBooks or NetSuite, can significantly reduce the risk of errors. These tools streamline bookkeeping, automate calculations, and generate financial statements that meet GAAP standards.

Implementing strong internal controls, staying up to date with FASB guidelines, conducting regular audits, and providing your team with proper training can help ensure compliance with US GAAP. If managing these activities feels challenging, you can also rely on accounting software designed to meet Generally Accepted Accounting Principles.

With so many accounting software options available, it’s easy for businesses to feel overwhelmed when trying to stay GAAP-compliant. To simplify your choice, here are 5 accounting software solutions that can help you maintain full compliance with US GAAP. Have a look at them.

5 GAAP-Compliant Accounting Software for Businesses of All Sizes

Whether you’re a small startup or a large enterprise, choosing the right accounting software is crucial to ensure accuracy, consistency, and compliance with US GAAP standards. The following options are trusted by businesses across industries for their robust features, user-friendly interfaces, and reliable compliance capabilities.

1. QuickBooks

QuickBooks is one of the most widely used accounting software solutions for small to medium-sized businesses. It simplifies day-to-day bookkeeping, automates complex calculations, and generates financial reports that are fully compliant with US GAAP standards. Its user-friendly interface makes it easy for business owners and accountants to maintain accurate records without extensive expertise.

Unique GAAP Feature: Its built-in reporting templates and automated journal entries help ensure financial statements remain GAAP-compliant.

2. NetSuite

NetSuite is a powerful, cloud-based ERP system designed for growing and large businesses. It provides advanced financial management features, real-time reporting, and automated compliance checks, ensuring your company adheres to GAAP principles. With its scalable structure, NetSuite can handle complex accounting needs while providing detailed insights into financial performance.

Unique GAAP Feature: Provides multi-dimensional financial reporting and audit trails that align with US GAAP standards.

3. Xero

Xero is a versatile cloud accounting platform that is particularly popular with small businesses and startups. It helps users manage invoices, track expenses, reconcile bank transactions, and maintain GAAP-compliant financial statements. Its integration capabilities with other business tools make it a convenient solution for streamlining accounting processes.

Unique GAAP Feature: Offers automated bank reconciliations and standardized reporting that simplify adherence to GAAP principles.

4. Sage Intacct

Sage Intacct is designed for medium to large enterprises that require comprehensive accounting and financial management tools. It offers automated workflows, detailed reporting, and multi-entity management, all while ensuring compliance with US GAAP standards. Businesses benefit from improved accuracy, faster closing processes, and enhanced visibility into their financial health.

Unique GAAP Feature: Its advanced automation for accounts and revenue recognition ensures full compliance with GAAP regulations.

5. FreshBooks

FreshBooks is a cloud-based accounting solution ideal for freelancers, consultants, and small business owners. It supports GAAP-compliant invoicing, expense tracking, and financial reporting, while also offering time-tracking and client management features. FreshBooks is particularly praised for its intuitive design and simplicity, helping users maintain compliance without added complexity.

Unique GAAP Feature: Provides GAAP-aligned expense categorization and financial summaries that make audit preparation easier.

In short, whether you are a small startup or a large enterprise, combining internal best practices with the right tools creates a robust financial management system.

Conclusion

Staying compliant with US GAAP is essential for businesses of all sizes to ensure accurate, transparent, and trustworthy financial reporting. By implementing strong internal controls, staying updated with FASB guidelines, conducting regular audits, and providing your accounting team with proper training, you can maintain compliance with GAAP principles. Additionally, leveraging GAAP-compliant accounting software like QuickBooks, NetSuite, Xero, Sage Intacct, or FreshBooks can simplify the process and reduce the risk of errors.

Hence, with the right approach and resources, staying GAAP-compliant can be efficient, manageable, and highly beneficial for your organization’s long-term financial health.

Frequently Asked Questions

GAAP, or Generally Accepted Accounting Principles, is a set of standardized accounting rules, principles, and procedures used in the United States to prepare and present financial statements. GAAP ensures consistency, transparency, and accuracy in financial reporting, making it easier for investors, regulators, and other stakeholders to understand and trust a company’s financial information.

Not exactly. GAAP is a general term for “Generally Accepted Accounting Principles,” which can exist in different countries with varying rules. US GAAP specifically refers to the set of accounting standards used in the United States, established by the Financial Accounting Standards Board (FASB). While both aim to ensure accurate and consistent financial reporting, US GAAP is tailored to comply with U.S. regulations and financial reporting requirements.

For construction businesses, accounting software must handle project-based accounting, job costing, and compliance with GAAP standards. For construction firms or contractors seeking a user-friendly solution, QuickBooks Construction Software is an excellent option. It provides GAAP-compliant financial statements, expense tracking, and project-based reporting, making it ideal for small to medium-sized construction businesses.

Failing to remain GAAP-compliant in the U.S. can have serious repercussions for a business. Non-compliance may lead to inaccurate or misleading financial statements, which can result in penalties from regulatory authorities, difficulties securing loans or investments, and loss of credibility with stakeholders. For publicly traded companies, the Securities and Exchange Commission (SEC) can impose fines, sanctions, or even legal action.

Additionally, non-compliance can trigger audits or investigations, increasing operational costs and reputational risk. Staying GAAP-compliant ensures transparency, builds trust with investors, and protects your business from legal and financial consequences.

The main difference between IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles) lies in their approach and usage. IFRS is used internationally and is principles-based, offering more flexibility in how financial transactions are interpreted and reported. In contrast, GAAP is primarily used in the U.S. and is rules-based, providing detailed, prescriptive guidelines for specific accounting scenarios.