When managing your business finances in QuickBooks, accuracy is the foundation of reliable decision-making. Two of the most commonly used reports, profit and loss (P&L) statements and Sales reports, play a crucial role in monitoring performance, tracking revenue, and evaluating business growth. However, many users encounter a common challenge: their Profit and Loss report doesn’t match the Sales report. This QuickBooks profit and loss discrepancy can be both confusing and concerning.

The profit and loss report summarizes your company’s total income and expenses, while the Sales report focuses specifically on customer-generated revenue. Ideally, certain figures should align between these reports. Yet, differences often appear due to factors such as mismatched report filters, cash versus accrual accounting methods, incorrect transaction dates, or sales item classifications.

If left unresolved, these discrepancies can complicate tax preparation, mislead financial decisions, and reduce the credibility of your reports with stakeholders. That’s why it’s essential to understand the root causes and learn how to fix them.

If your profit and loss report does not match the sales report in QuickBooks, then you’re right on the page to find the solution. In this blog, we’ll break down the most common reasons behind a QuickBooks profit and loss discrepancy and provide actionable steps to troubleshoot and correct mismatched reports, helping you maintain clean, accurate, and trustworthy financial records.

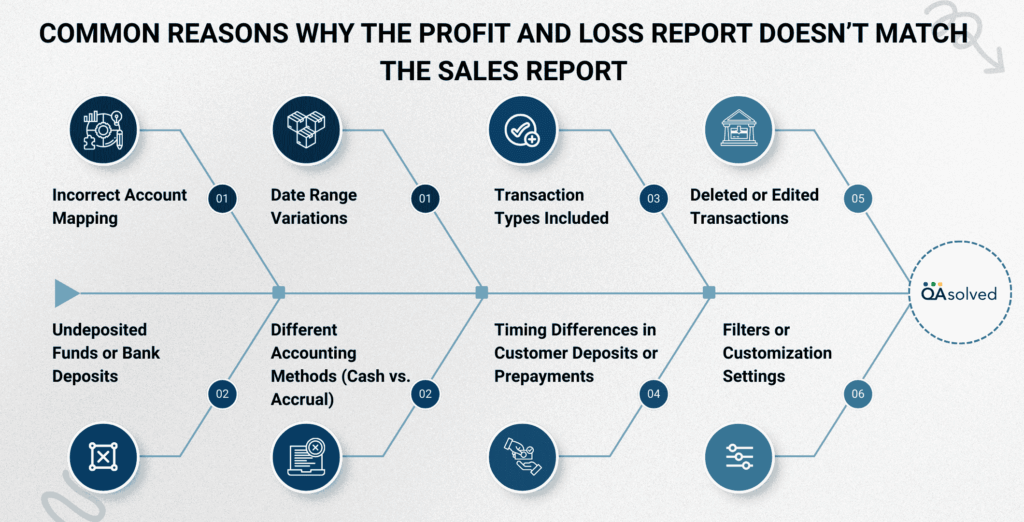

Common Reasons Why Profit and Loss Report Doesn’t Match Sales Report

It’s not unusual to see differences between your profit and loss (P&L) report and sales reports in QuickBooks. These mismatches aren’t necessarily caused by errors in your books – they could be caused by differences in report settings, accounting methods, or the way transactions were recorded. The following are the most common causes of this issue:

1. Different Accounting Methods (Cash vs. Accrual)

If your profit and loss report is set to accrual basis while your sales report is set to cash basis, the totals will rarely match. Cash basis reports only show income when payments are received, whereas accrual basis reports show income when it is earned.

2. Date Range Variations

Even a minor difference in date filters can cause reports to display different totals. For example, if the P&L report covers January 1–31 but the Sales report covers January 5–31, the results will not align.

3. Transaction Types Included

Your profit and loss report includes all income and expense accounts, while the sales report focuses only on sales-related transactions. Deposits, refunds, discounts, or adjustments may appear in one report but not in the other.

4. Undeposited Funds or Bank Deposits

Discrepancies often arise if customer payments remain in the undeposited funds account and are not yet moved to a bank account. This difference between recorded sales and actual deposits can lead to mismatches.

5. Deleted or Edited Transactions

If invoices, payments, or sales receipts are deleted or modified, one report may reflect the changes while the other does not, leading to inconsistencies.

6. Incorrect Account Mapping

Sometimes sales items are mapped to the wrong income account. For instance, if a sales item is linked to an “Other Income” account instead of the primary sales account, it may not show up in the sales report as expected.

7. Timing Differences in Customer Deposits or Prepayments

Upfront payments or customer deposits are often recorded as liabilities first and later moved to income. This timing difference can cause variations between the profit and loss and sales reports.

8. Filters or Customization Settings

Applying custom filters, such as filtering by customer, job, or class, may exclude certain transactions. This can result in mismatched totals between the two reports.

To maintain clean and reliable books, you need to understand why your profit and loss report does not align with your sales report. Mismatches are usually caused by simple issues, like filters, date ranges, or accounting methods, which can be corrected easily once identified. A QuickBooks profit and loss discrepancy can not only keep your records accurate, but also give you the confidence to make smarter business decisions.

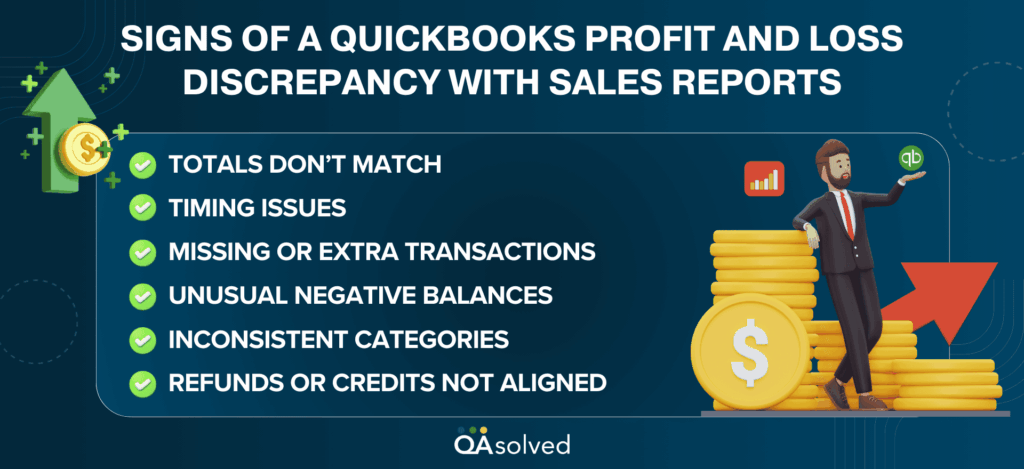

Signs of QuickBooks Profit and Loss Discrepancy with Sales Reports

The warning signs of out-of-balance books can be found in your reports. Identifying these signs early allows you to investigate and resolve the issue before it becomes more serious. Here are some common indicators that your profit and loss (P&L) report may not be lining up with your sales reports:

- Totals Don’t Match: Profit and Loss report income amounts differ from sales report sales amounts for the same period.

- Timing Issues: There may be a mismatch in the date ranges or cash vs. accrual settings that results in payments appearing on one report but not the other.

- Missing or Extra Transactions: One report seems to include invoices, sales receipts, or deposits, but another report appears to exclude them.

- Unusual Negative Balances: A negative balance in income accounts or a report showing less income than expected might indicate a discrepancy.

- Inconsistent Categories: There are some sales items that appear in the P&L but not in the sales report under “Other Income” or unexpected categories.

- Refunds or Credits Not Aligned: The refunds or credit memos applied to customer accounts may appear in one report but not reduce the totals correctly in the other.

The earlier you recognize these warning signs, the better your chances of troubleshooting and fixing mismatches will be.Keeping an eye out for inconsistencies will help you ensure your financial reports remain accurate and dependable.

Steps To Fix Profit and Loss Reports That Do Not Match A Sales Report

Having identified the common causes of mismatched totals, you need to fix them. Correcting a profit & loss report not matching sales report in QuickBooks issue requires a methodical approach-checking settings, reviewing accounts, and ensuring transactions are recorded properly. By following the steps outlined below, you’ll be able to identify the source of the discrepancy and bring your reports back in line, giving you reliable financial data to work with.

Step 1: Verify That Reports Have The Same Date Range And Basis

- Select Customize report on each report.

- Click on the All dropdown and select the dates you want.

- Select Accrual as the report basis, then click OK.

- Check the reports.

Proceed to Step 2 if the income amounts in the two reports still do not match.

Step 2: Confirm Items Are Directed To The Proper Accounts

- Go to the Lists menu and select Item List.

- Select Customize Columns from the Item List by right-clicking anywhere.

- Ensure that the Account and Cost Account columns are included.

- Review the accounts linked to each sales item.

- Update any items that are assigned to the wrong accounts.

- Re-run the reports to check for accuracy.

Follow Step 3 if the income amount is still a discrepancy between the two reports.

Step 3: Check For Transactions Without Items

- Set the Date to All and run the Profit & Loss report on the Accrual basis.

- Double-click the amount in question to drill down into the details.

- In the detail report, change Total By to Item, then refresh the report.

- Scroll to the bottom to locate any transactions grouped under “No Item.”

- Recheck your reports for discrepancies.

If these transactions don’t account for the difference between the two reports, move on to Step 4.

Step 4: Look For Possible Data File Damage

Discover the steps to repair company file data issues. Once you’ve completed the steps in this article, review your reports again. If the income amounts between the two reports still don’t match, move on to Step 5.

Step 5: Compare Detail Reports Line by Line to Spot Differences

- Run the Profit and Loss report

- Choose the Company & Financial > Profit & Loss Standard.

- Click on Customize Report.

- From the Dates dropdown, choose All, and set the basis to Accrual.

- Click twice on the account you wish to drill down into.

- Change Total By to Item.

- Run the Sales report

- Go to Sales > Sales by Item Summary.

- Choose Customize Report.

- From the Dates dropdown, choose All, and set the basis to Accrual.

- For summary reports, double-click to drill down into the total amount.

- Change Total By to Item.

- Make sure all source reports are closed, and only the two detailed reports remain open.

- From the Window menu, select Tile Vertically.

- Identify discrepancies by comparing the reports line by line.

Addressing these discrepancies not only restores accuracy to your financial reports but also strengthens your bookkeeping practices, ensuring you always have reliable insights to guide important business decisions. By following a structured approach including, verifying report settings, confirming item-to-account mapping, checking for “No Item” transactions, repairing data issues, and comparing detailed reports line by line, you can quickly pinpoint the root cause.

Conclusion

When your profit and loss report doesn’t match your sales report in QuickBooks, it can quickly become frustrating. These reports are essential for tracking revenue, measuring profitability, and making informed decisions, so discrepancies can’t be ignored. Mismatches often occur due to factors like incorrect date ranges, cash vs. accrual methods, misclassified items, or even hidden data damage. Left unresolved, these errors may distort profitability, affect tax filings, or lead to poor planning.

By understanding why these discrepancies happen and following a systematic approach to review settings, account mapping, and transactions, you can identify and correct the issue. Once your reports are aligned, you’ll have accurate financial insights that strengthen your bookkeeping practices and give you confidence in your numbers.

Frequently Asked Questions

Profit and Loss reports don’t always match bank statements because they measure different things. Your P&L shows income and expenses (based on cash or accrual accounting), while your bank statement shows actual money coming in and going out. Common causes include timing differences, outstanding checks or deposits, unrecorded bank fees, and accounting method differences. To align them, use bank reconciliation in QuickBooks.

Your P&L can show a profit while your bank account is empty because profit doesn’t equal cash. You’ll find income you’ve earned (like unpaid invoices) and expenses you’ve incurred (like unpaid bills). However, your bank only shows actual money coming in and going out. The timing of payments, loan repayments, or large purchases can all cause profit on paper without cash.

When reconciling a Profit and Loss account in QuickBooks, compare the transactions listed on the report with the supporting records (such as sales reports, expense receipts, and bank statements). Ensure that:

1. The date range and accounting basis (cash vs. accrual) are correct.

2. Income and expense items are mapped to the right accounts.

3. All transactions (sales, bills, fees, etc.) are entered and not duplicated.

4. Run a bank reconciliation to confirm your books match actual cash activity.

Look for missing or misclassified entries in the detail reports if discrepancies persist.

Following are the basic accounting principles that apply to Profit and Loss accounts:

– All incomes and gains are credited

– All expenses and losses are debited

Revenue increases the credit side of the P&L, while expenses reduce profit and are recorded on the debit side. At the end of the period, the net balance shows either profit (if credits > debits) or loss (if debits > credits).