The healthcare sector is among the most complex and highly regulated globally. Beyond delivering quality care, these professionals must juggle intricate financial processes that involve patient billing, insurance claims, payroll, and compliance reporting. Unlike other business verticals, healthcare organizations cannot rely solely on generic accounting software to manage these tasks effectively. The financial demands of this industry necessitate tools and capabilities specifically designed to address its unique challenges. Industry-specific healthcare accounting software fills this gap by offering tailored features that not only streamline operations but also improve accuracy to help professionals stay compliant while keeping their focus on top-notch human care.

If you’re looking for a guide to better understand and manage medical accounting software, you’re in the right place. In this blog, we’ll walk you through why healthcare providers need industry-specific accounting tools, the importance of having a robust accounting system, and the key financial metrics every healthcare business should track. On top of this, we will also help you with a list of the top five accounting software options for healthcare businesses so that you can make better decision straight away. So, let’s begin with it.

What Makes Accounting in Healthcare Complex in Today’s Landscape?

Accounting in the healthcare industry is unlike traditional business accounting. It involves balancing patient care with financial management, all while meeting strict regulatory standards. The mix of insurance claims, government programs, patient billing, and compliance requirements adds layers of complexity that few other industries face. This makes healthcare accounting both unique and challenging to manage without specialized tools and expertise.

Here are the seven factors that make healthcare accounting tedious in the present scenario:

1. Insurance and Reimbursements

Unlike other industries, much of healthcare revenue comes from third-party payers such as insurance companies or government programs. Delays, denials, and varying reimbursement rates add complications to financial management.

2. Regulatory Compliance

Healthcare organizations must comply with numerous laws and standards, including HIPAA, Medicare, and tax regulations. Staying compliant requires detailed record-keeping, reporting, and strict data security measures.

3. Staff Shortages

A lack of skilled healthcare accountants can create serious challenges for providers. Shortages often result in delayed billing, slower reimbursements, and disruptions to financial workflows.

4. Multiple Revenue Streams

From patient payments to insurance reimbursements and grants, healthcare providers manage diverse income sources. Tracking and reconciling these streams can be difficult without the right systems in place.

5. High Operating Costs

Staffing, equipment, facilities, and medical supplies all contribute to significant expenses. Managing these costs while maintaining profitability requires careful budgeting and cost-control strategies.

6. Patient-Centric Billing

Unlike standard invoices in other industries, healthcare billing must reflect treatments, procedures, and insurance coverage. This makes patient billing complex and prone to errors if not handled properly.

7. Technology Integration

Healthcare providers rely on multiple systems, including electronic health records and billing platforms. Integrating accounting software with these tools is often complex and requires careful planning.

Importance of Having a Robust Accounting Software for Healthcare Industry

As we said, the healthcare industry runs on both quality patient care and strong financial management. With countless transactions, regulatory requirements, and operational costs, having a reliable accounting software is no longer optional; it is essential. Why? Because a robust financial system ensures efficiency, accuracy, and compliance, making day-to-day operations smoother for providers.

Here are the seven key reasons why medical professionals and organizations need a robust healthcare accounting software:

1. Accurate Patient Billing

Billing errors can frustrate patients and delay payments. Advanced accounting software automates billing, generates detailed invoices, and integrates with patient records. This reduces mistakes, improves transparency, and ensures patients understand their charges, ultimately leading to faster collections and improved trust.

2. Streamlined Insurance Claim Management

Insurance claims are often complex and time-consuming. With dedicated tools, providers can track, process, and submit claims with greater accuracy. Automated claim status updates minimize delays, reduce denials, and ensure healthcare providers receive reimbursements more quickly.

3. Regulatory Compliance

Healthcare is governed by strict regulations around data security, tax reporting, and financial transparency. Robust accounting software keeps records organized, maintains audit trails, and generates compliant reports, helping organizations avoid penalties while staying aligned with industry standards.

4. Efficient Payroll Management

Managing staff wages, overtime, and benefits manually can be overwhelming in large practices or hospitals. Accounting software simplifies payroll processing by automating salary calculations, deductions, and tax filings, ensuring staff are paid on time without errors.

5. Improved Financial Transparency

Clear financial insights are vital for sustainable growth. With dashboards and real-time reporting, accounting tools provide a complete view of revenue streams, expenses, and cash flow. This helps administrators make informed decisions backed by accurate financial data.

6. Cost Control and Budgeting

Overspending can strain healthcare organizations. Accounting software helps track expenses, compare them against budgets, and identify areas of unnecessary spending. This makes it easier to plan ahead, allocate resources efficiently, and keep costs under control.

7. Time Savings and Productivity

Automating repetitive tasks like data entry, reconciliations, and invoice tracking frees up staff time. By reducing manual workloads, providers can focus more on strategic planning and patient care instead of administrative tasks.

Also Read: 10 Factors to Consider While Choosing Accounting Software

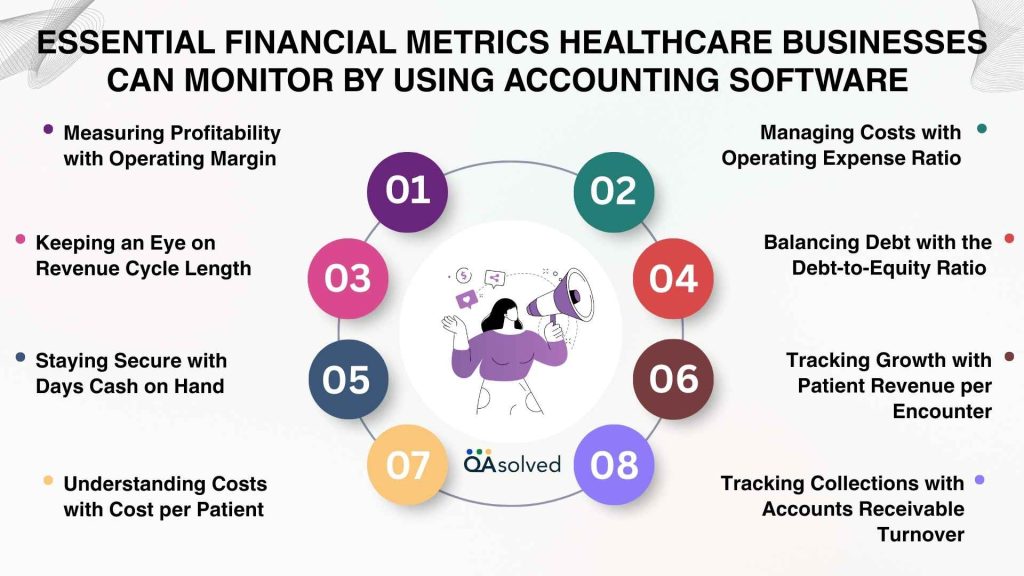

Essential Financial Metrics Healthcare Businesses Can Monitor by Using Accounting Software

Tracking the right financial metrics is critical for healthcare businesses to maintain stability and growth. These metrics provide a clear picture of revenues, expenses, and overall financial health, ensuring providers can balance patient care with sustainable operations. So, let’s discuss how using the best healthcare accounting software can actually be a game changer.

1. Measuring Profitability with Operating Margin

Think of operating margin as the big picture of your financial health. It shows how profitable your core operations are. A higher margin means you’re managing costs well compared to your revenue, which is a strong sign your organization is on the right track.

2. Keeping an Eye on Revenue Cycle Length

Getting paid on time is just as important as providing great care. Revenue cycle length tracks how long it takes for payments to arrive after services are delivered. The shorter the cycle, the faster your cash flow, giving your organization more financial flexibility.

3. Staying Secure with Days Cash on Hand

Unexpected expenses are part of healthcare. Days cash on hand tells you how many days you could keep running with the cash reserves you already have. It’s a critical metric for knowing just how financially secure your organization is.

4. Understanding Costs with Cost per Patient

How much does it really cost to care for one patient? Cost per patient answers that question. By keeping an eye on this metric, providers can spot areas to reduce expenses and make smarter use of resources, without compromising quality care.

5. Managing Costs with Operating Expense Ratio

Every healthcare provider has day-to-day expenses, from staff salaries to utilities and supplies. The operating expense ratio shows what percentage of revenue goes into these costs. A lower ratio means you’re running more efficiently and keeping more of your income as profit.

6. Balancing Debt with the Debt-to-Equity Ratio

Healthcare providers often take on loans for expansion or expensive medical equipment. The debt-to-equity ratio helps you see whether you’re relying too much on borrowed money. A lower ratio is generally better, showing stability and less financial risk.

7. Tracking Growth with Patient Revenue per Encounter

Not all patient visits generate the same level of income. Patient revenue per encounter helps you see the average revenue earned each time a patient is treated. It’s a handy way to spot which services perform well and where there’s room for improvement.

8. Tracking Collections with Accounts Receivable Turnover

Slow payments can create major cash flow headaches. Accounts receivable turnover shows how quickly you’re collecting money from patients and insurance companies. The higher the rate, the faster your collections, and the smoother your revenue cycle.

So, these are some of the key aspects that a healthcare organization can manage and monitor by using accounting software.

How Accounting Software Help Healthcare Organizations Stay Compliant?

Compliance is one of the biggest challenges in the healthcare industry, where even small financial or data errors can lead to heavy penalties. Here are the prominent factors that can help healthcare organizations to stay compliant with the regulations.

1. Automated Reporting

Healthcare regulations often demand precise financial reporting. Accounting software generates reports automatically, reducing the risk of errors and saving staff hours of manual work. This ensures providers always have accurate records ready for audits or regulatory submissions.

2. Audit Readiness

Preparing for audits can be stressful and time-consuming. With built-in audit trails, accounting software records every transaction in detail, making it easier to trace discrepancies and prove compliance. This creates confidence and transparency when auditors come knocking.

3. Data Security

Protecting sensitive financial data of patients is critical in healthcare. Robust accounting systems use encryption, access controls, and secure backups to keep information safe. These features not only support HIPAA compliance but also build patient trust.

4. Integrated Record-Keeping

Financial compliance depends on having consistent and accurate records. Accounting software integrates billing, payroll, and expense tracking in one place, eliminating duplicate entries and improving data reliability. This centralization makes compliance easier to maintain.

5. Error Reduction

Manual processes leave room for costly mistakes. Automated accounting tools reduce data entry errors and flag inconsistencies before they cause bigger compliance issues. Fewer errors mean fewer risks of fines or regulatory trouble.

5 Top-Rated Accounting Software for Healthcare Businesses

Navigating the financial side of healthcare means balancing billing, reimbursements, payroll, and compliance, all while maintaining accuracy and focusing on patient care. The right accounting software can be a game-changer. Here are five highly rated accounting software solutions for healthcare professionals and organizations:

1. Sage Intacct – Best Overall for Healthcare Accounting

A cloud-based powerhouse, Sage Intacct offers compliance-focused security, multidimensional reporting, and flexible automation, perfect for multi-site clinics or large care networks. It streamlines cost tracking, donor or grant management, and audit compliance with features tailored for the healthcare sector.

2. Oracle NetSuite – Best for Hospitals and Complex Operations

NetSuite combines ERP and financial modules in a unified cloud environment, making it ideal for large-scale hospitals or integrated health systems. Its strength lies in centralized financial control, configurability for medical billing workflows, and seamless integration capabilities.

3. FreshBooks – Best for Solo Practices and Consultancies

If you are a small healthcare provider such as an independent doctor or therapist, FreshBooks is user-friendly, affordable, and efficient. It simplifies time tracking, invoicing, and expense management, with integrations that can tie into scheduling or basic EHR systems.

4. QuickBooks – Flexible for Small to Mid-Sized Practices

QuickBooks is familiar and flexible. Solo clinics often go for QuickBooks Online with medical-specific add-ons, while larger offices may choose the Desktop Enterprise version, which supports robust reporting, inventory tracking, and multi-user permissions consistent with healthcare workflows.

5. Zoho Books – Budget-Friendly and Scalable

This is a solid pick for small to mid-sized healthcare businesses already using Zoho’s suite. It offers automation for invoicing, insurance payment tracking, and expense categorization, with custom client portals and affordable pricing.

Conclusion

Managing finances in the healthcare industry is not just about crunching numbers, it is about ensuring stability, compliance, and efficiency in an environment where patient care comes first. From tracking essential financial metrics to overcoming the unique challenges of healthcare accounting, the right software can make a significant difference. Hospitals and clinics that invest in specialized accounting solutions can streamline billing and reimbursements, strengthen compliance, optimize resources, and gain clearer financial insights.

Whether you run a solo practice, a mid-sized clinic, or a large hospital network, choosing the right accounting software tailored to healthcare needs is a step toward stronger financial health and better patient outcomes.

Frequently Asked Questions

Not all accounting software is designed to handle sensitive patient information, but some platforms are built with HIPAA compliance in mind. Solutions such as Sage Intacct, Oracle NetSuite, and Microsoft Dynamics 365 can be configured to meet HIPAA standards, especially when integrated with secure healthcare systems.

The best software varies depending on the size and needs of the healthcare provider:

1. For Large Hospitals and Health Systems: Oracle NetSuite, SAP S/4HANA, and Microsoft Dynamics 365 Finance

– Offer scalability, advanced reporting, and integration with EHRs

– Strong compliance tools suitable for complex operations

2. For Mid-Sized Healthcare Practices: Sage Intacct

– Provides healthcare-focused features, detailed financial reporting, and automation

– Well-suited for growing organizations with multiple facilities

3. For Small Clinics and Solo Practitioners: QuickBooks and FreshBooks

– Affordable, user-friendly, and easy to customize with medical add-ons

– Great for handling billing, expense tracking, and basic compliance needs

Yes, some hospitals and healthcare facilities do use QuickBooks, particularly when hosted on the cloud for added security and scalability.

Relational databases are the most widely used in healthcare settings. They are designed to manage structured data efficiently, which makes them ideal for handling patient records, medical histories, treatments, billing details, and vital signs. By organizing information into interconnected tables, relational databases ensure accuracy, consistency, and quick access to critical data. This structured approach not only supports daily operations but also helps healthcare providers maintain compliance and improve decision-making.